In recent weeks, I’ve written about the various risk premiums that have been found in academia that both explain returns and offer some hope of beating the market.

Each time, I wished that I could link back to an article that explains the concept more fully, so today, I am going to write the first of a series of articles explaining the well-known risk premiums.

First up is the size premium, which refers to the fact that, historically, small company stocks have tended to outperform the large company stocks. This was first formally recognized by academia in a paper by Rolf Banz in 1981.

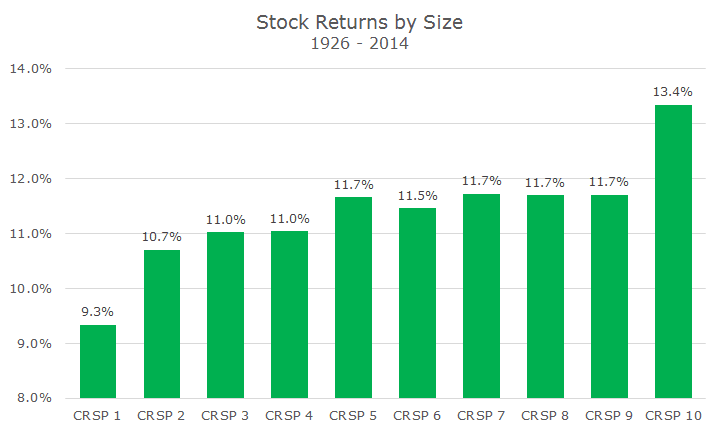

The paper was one of the first discoveries to come out of the University of Chicago Center for Research and Securities Prices, or CRSP (pronounced ‘crisp’). The following chart shows the returns for the entire stock market broken down into deciles based on the size of the company.

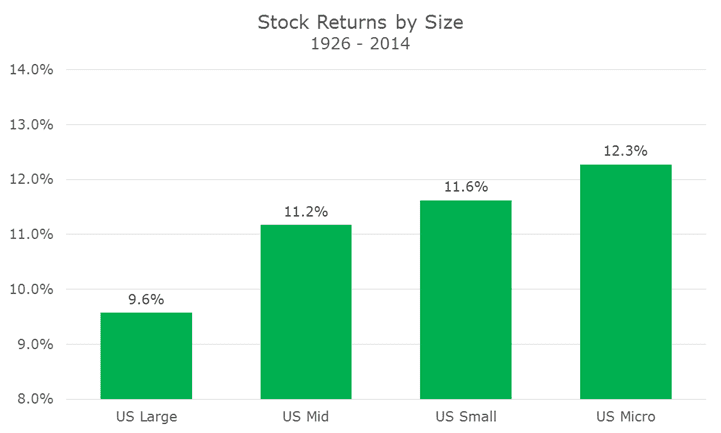

The implication is obvious: small companies have outperformed large companies. The largest (and most familiar) stocks have the worst performance and the smallest companies are heads and shoulders above the rest of the market. CRSP organizes the ten deciles into four groups: large, mid, small and micro cap.

The harder part is determining why small cap stocks should earn better performance. The conventional wisdom in academia that we accept is that smaller companies are inherently riskier than larger companies.

That means that investors aren’t willing to pay as much for them, so they apply a larger discount rate to the expected future cash flows. Ultimately, the higher discount rate translates into a higher expected and realized return.

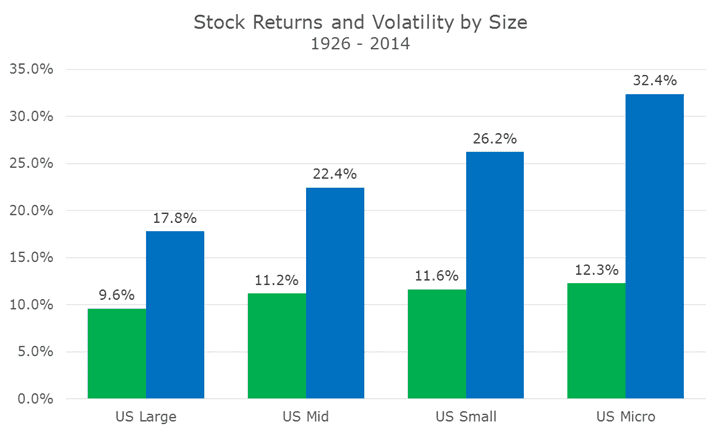

Of course, the excess returns aren’t a free lunch and one of the ways that investors can see the higher risk is the higher realized volatility of each asset class.

While the difference in return is meaningful when compounded over 88 years, the difference in returns is marginal compared to the difference in volatility – micro cap stocks have earned an additional 28.1 percent per year on average compared to large cap stocks, but the volatility is 82.0 percent higher.

In other words, the level of return per unit of risk is much less for micro cap stocks than it is for large cap stocks, which is why we allocate much more to large cap than micro cap even though the returns have been higher for micro cap.

We want to overweight the smaller asset classes compared to the natural market weight, but not so much that investors won’t be able to handle the additional volatility.

Although the size premium is one of the easiest market anomalies to understand, it is also the smallest. In fact, the additional return of 2.7 percent is so small and the volatility is so high that some debate whether the premium still exists.

I first covered the question of whether the size premium exists last December and you can re-immerse yourself by clicking here. I also wrote about how researchers at AQR have ‘resurrected’ the size premium by controlling for the quality of a stock, which you can find here.

I don’t doubt the AQR paper (it’s quite good), but I think they may be over doing it a little with the resurrection claims.

We had come to the conclusion a few years ago that overweighting to small cap made sense because it adds important diversification to your portfolio and allows you to access other premiums like value and momentum.

Other research by DFA had shown that as long as you removed the most expensive companies from small cap, or ‘extreme growth’ as they called it, the size premium was still intact.

In our view, the debate over the existence of the size premium is a bit of a red herring and believe that an overweight to small cap stocks, especially when you are also getting exposure to other premiums, is sensible and appropriate in a well-diversified portfolio.