Value stocks are undoubtedly having a tough time these days. As I first wrote last November (click here for the article), value stocks are undergoing their worst period of underperformance since the tech bubble during the late 1990s.

For the 10 years ending January 31st, the Russell 1000 Value index is up 7.03 percent compared to 7.92 percent for the Russell 1000 index of large cap stocks and 8.68 percent for the Russell 1000 Growth index.

Some practitioners are wondering whether value investing, the practice of buying cheap companies (explained in more detail here) is dead.

Personally, I think this is a silly question and my evidence that value is alive and well can be found overseas (an unlikely place for good investment news these days!).

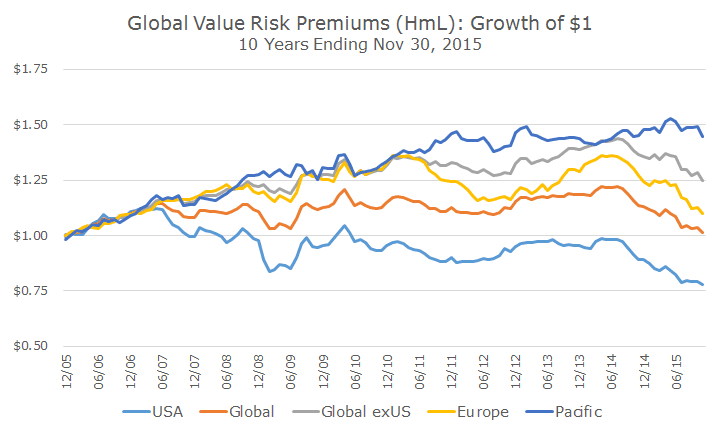

The chart below plots the cumulative growth of what academics call risk premiums, which are the return differentials between different kinds of stocks.

In this case, we’re looking at the performance of cheap stocks compared to expensive stocks without considering the overall market performance.

For example, in the Russell index that I referenced above, all three made money, but if you stripped out the overall market return, you could more clearly see the difference between value and growth stocks.

In the chart below, we see the value premium for value stocks in light blue at the bottom. A dollar invested this way (you can’t since this is an academic index), would have gone up initially, fallen sharply during the 2008 crisis, recovered somewhat and fallen again starting in 2014.

That’s the terrible performance we’re talking about: value stocks losing money relative to growth stocks. But as you can see from the key, this only applies to US stocks.

Now let’s take a look around the world and see how value is faring. Let’s start at the top with the dark blue line, which represents value stocks in the Pacific (and therefore basically means Japan, just like how America is basically North America from an investment perspective).

If you could invest in a long-short portfolio of Pacific Rim value stocks, your dollar would be up 50 percent, so we can conclude that value investing is doing just fine across the Pacific!

Because the Pacific was so strong, if you look at the developed world (this excludes emerging markets) excluding the US, you can see with the grey line that value did just fine, much better than growth.

Europe did okay, but not great as indicated in yellow, and the whole world in orange, which is about 50 percent US, value broke even versus growth.

So at the very least, you have to re-ask the question a little differently and wonder if value investing is dead in the US and alive in the rest of the world. It seems like a dubious proposition.

When researchers find a risk premium like value, size, momentum or quality, they always look for what they call ‘out of sample’ evidence.

One way to find ‘out of sample’ evidence is to see if the strategy works in other countries, because if you find something that only works in Canada or Denmark but nowhere else, you probably haven’t found anything.

It’s well known that risk premiums underperform, which is why they call them risk premiums. If there was no risk of loss or underperformance, everyone would pursue these strategies.

We know that every strategy has periods of underperformance but in the long run, we believe the winning periods will pay for the losing periods and then some.

At the same time, we also protect ourselves by diversifying: we don’t have just value exposure, we also invest in smaller stocks, stocks with positive momentum and high quality stocks. While size is struggling too, momentum and quality are doing well.

We diversify in many ways: by minimizing single company exposure, by geography, market capitalization, the economic status (developed vs emerging), sector, industry and, less obviously, by risk premium.

And all of that doesn’t even mention bonds! Just having them is the most important factor, but we diversify by sector, duration, credit quality and a variety of lesser known attributes that I’ll have to save for another day.

Is value investing dead? Of course, you never really know what the future holds, but it seems highly unlikely to us.