Personally, I was a little surprised that stocks held up as well as they did yesterday after the failed coup in Turkey.

Even though the political regime ultimately didn’t change, I thought that tanks rolling through the capitol would be enough to remind everyone that emerging markets (EM) are risky.

Instead, the MSCI Emerging Markets index gained 0.26 percent and the two main ETFs that track EM stocks both gained 0.88 percent (the EM index stops tracking prices when foreign markets close, but the ETFs keep trading, which is why the fund returns differ so much from the index – click here for a more detailed explanation).

Turkey itself is nothing to worry about since our exposure is tiny – Turkish stocks only compromise 1.6 percent of our EM exposure, which in turn isn’t more than five percent of our equity allocation. A typical 60/40 client of Acropolis has less than a 0.05 percent allocation to Turkish stocks.

Still, the political unrest could have had a much greater impact on the segment – remember the massive impact that Greece had on European stocks despite their small economic footprint? I realize that there are some important differences, but the idea that I am trying to get across is that small bad things can have a much bigger impact.

This political risk is exactly why we think that EM stocks should earn more than US stocks. We think that risk and return go hand in hand and that the risk that the military can topple a democracy is unlikely in the developed world and should cause investors to discount their cash flow expectations in EM markets.

It’s also exactly why we diversify across all of the emerging markets and don’t try to pick countries anymore (when we got going almost 14 years ago, there were no EM ETFs, so we bought country specific closed end funds).

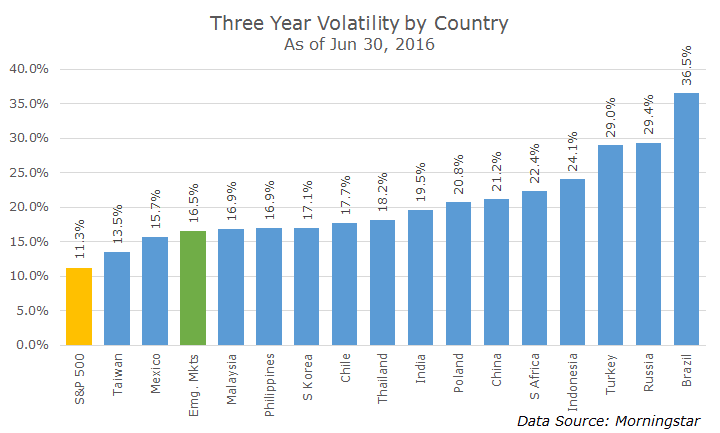

The following chart shows the realized volatility of the top 15 countries in the MSCI EM index. Even though we use FTSE EM indexes to invest, it was easier to find MSCI data.

You can see that every single market has experienced more volatility than the US over the past three years (three year’s isn’t special, but, again, the data was easy to get and the point is right).

What’s more interesting is that the volatility of the diversified portfolio is lower than all but two of the individual markets. Of course, that’s because they aren’t perfectly correlated.

We all tend to think of EM stocks as one big uniform group, but they are often lowly correlated with each other. Over the past three years, for example, India has gained approximately 21 percent while Poland lost around -28 percent.

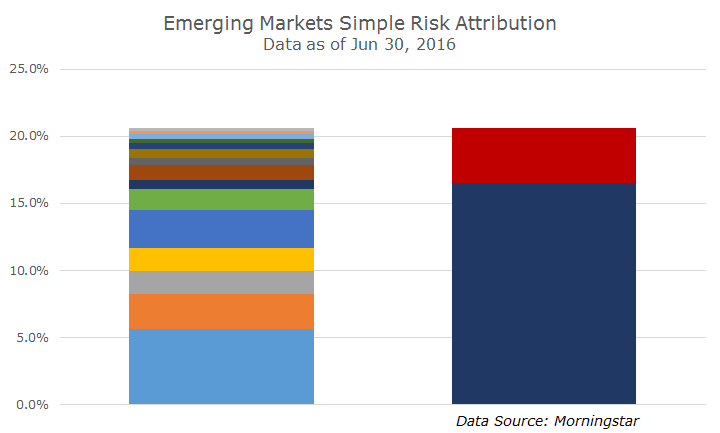

I made a second chart that I hope will show the diversification benefit.

The left hand column shows the simple weighted average of realized volatility for each country. China, at the bottom in blue, is about 25 percent of the index and realized volatility of 26.6 percent. Therefore, the simple weighted average is 5.65 percent.

When you do this across all of the countries (well, I only did the top 15, but they cover 96 percent of the holdings), the total realized volatility of all of the components is 20.66 percent.

Here’s the interesting part: the realized volatility for the index was only 16.53 percent – a reduction of about 20 percent. I’ve got that in dark blue on the right hand column.

The red part of the right hand column represents the diversification benefit of holding emerging markets as a group. You could get the same thing by holding all of the individual components, but the idea is that because they are lowly correlated with each other, the overall volatility drops. When one country zigs, another country zags.

You could easily imagine how these numbers change. Over the last three years, Taiwan had the lowest volatility, but it’s not a stretch to think that the Chinese military activity in the South China Sea could change this dramatically.

The diversification benefits can be found throughout the portfolio with stocks and bonds, corporate bonds versus Treasury bonds, micro cap stocks with US stocks, etc. It’s one of our bedrock beliefs and it’s often said that diversification is the only free lunch in investing, so enjoy copious portions.