As noted in yesterday’s Daily Insights, Gross Domestic Product (GDP) in the first quarter was pretty bad – we actually contracted at an annualized rate of -0.7 percent. As bad as that is (and it’s pretty bad), it’s actually better than the first quarter of last year, which saw an annualized contraction of -2.1 percent.

Last year, we could blame the drop in output on the polar vortex that made for an extremely cold winter. As you might expect, once the weather warmed up, the economy heated up as well and the next two quarters saw very healthy growth of 4.6 and 5.0 percent.

Can we expect a healthy rebound this year like the one that we enjoyed last year? It’s hard to say – and not just because yesterday was the first day of June and the high in St. Louis was 64 degrees.

While the weather this past winter was pretty cold, especially for those in Boston who had record snowfall, it wasn’t nearly as cold the one before. Still, the weather probably had a slowing effect. I’ve seen on analysis that estimates that the snowfall knocked -0.8 percent off of first quarter GDP.

But that snowfall adjustment only gets us to zero, which is well below what the economy has traditionally delivered – even during this extremely slow recovery.

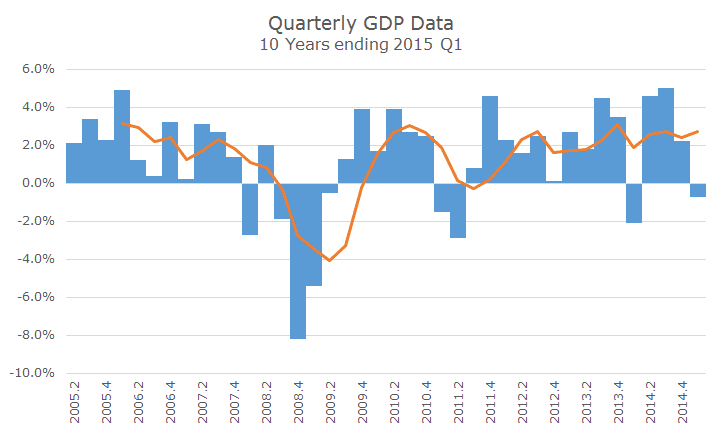

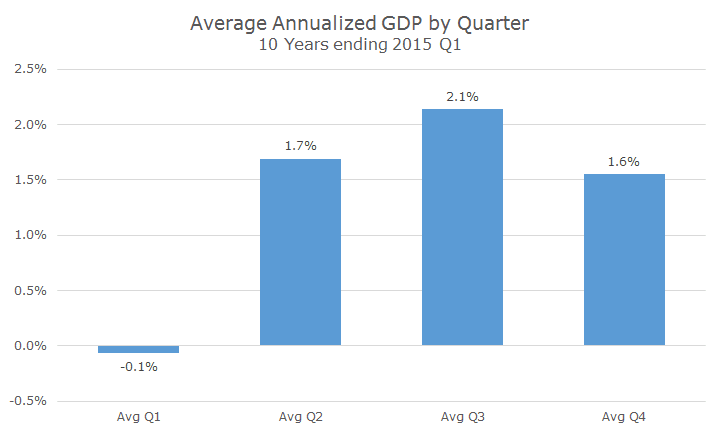

As I prepared the chart above, I did notice that the first quarter tends to be tough. I’ve read other reports that say these numbers look even better than reality because they are seasonally adjusted.

Even with the adjustment, the first quarter has been substantially worse over the last 10 years than the other quarters, which is somewhat amazing since the fourth quarter bore the brunt of the 2008 financial crisis.

Even still, bad first quarters in the recent past is a highly unsatisfactory answer in my opinion. I did a little digging to try and find out what other factors may have had an adverse effect on first quarter GDP and have a few thoughts.

Although it was easy to ignore here in the Midwest, there was a major disruption to business inventories due to a work slowdown at the ports on the West Coast. There was a nine-month standoff between the shippers and longshoremen that really slowed down imports and exports that reportedly cost the economy $2 billion per day.

The ports are back up and running and it will take a while to open things up again, but it’s clear that the slowdown had a negative, albeit temporary effect on the economy.

On a semi-related front, the strong dollar was probably a headwind for the overall economy. In some ways a strong dollar is good because it lowers prices for consumers. It makes our exports more expensive overseas, but we are definitely a net importer, so it should help.

The problem is that if the economy is weak and consumers aren’t spending much anyway, the lower prices have a limited effect. If the economy was strong, like in the late 1990s, then the strong dollar would be a plus, but right now, it isn’t particularly helpful.

The dollar did start to weaken at the end of the first quarter, but has picked up again recently, so it’s hard to say what the impact will be on GDP in the next few quarters.

A third factor slowing GDP is the selloff in oil prices. While we all love lower prices at the pump, we’ve had a bit of an energy renaissance in the US that is seriously undercut by lower energy prices. Capital expenditures at energy companies have been substantial, although it has leveled off some as oil prices seem to have stopped falling.

The combination of these effects makes me think that the drop in first quarter GDP was somewhat transitory and I think, along with the consensus of economists, that GDP will rebound in the second quarter to something closer to trend growth, which has been around two percent since the end of the crisis.

One interesting data point to watch is the Atlanta Federal Reserve GDP Now model that attempts to forecast GDP in real time (click here to visit their website). Last quarter, they said that growth would be 0.2 percent, which turned out to be too optimistic, but was much closer than the blue chip forecasters.

Right now, with a month to go before the quarter ends, the GDP Now model is calling for first quarter growth of 0.8 percent, lower than the trend number that I mentioned and, again, lower than the blue chip economists.

As always, time will tell. For now, markets seem content with all of the forecasts as stocks have been trading in a relatively tight range for the year.