The consensus growth forecast for third quarter GDP was 3.00 percent, so markets responded happily to the 3.55 percent reading from the Bureau of Economic Analysis.

The largest contribution to growth came from net exports, which grew at a rate of 1.32 percent and consumer spending added 1.22 percent while inventories were a negative contributor at -0.57 percent.

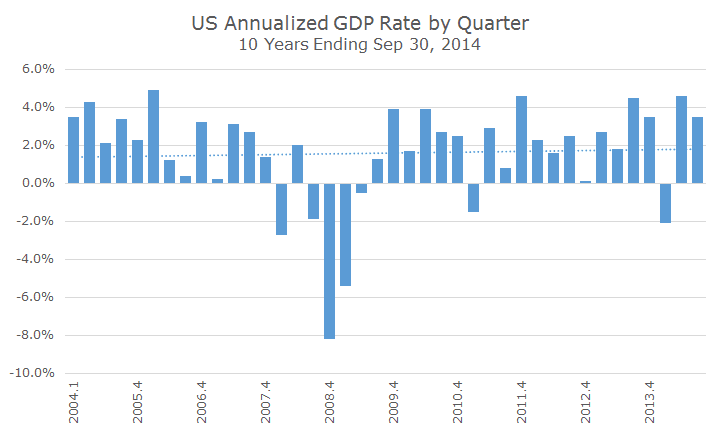

I am always a little confused by how the government reports GDP numbers. In the data and chart above, the annualized growth rate is shown for each quarter.

I’m not sure why that’s the convention, but another way to look at it is by considering the growth rate from a year ago, which was 2.3 percent. To me, that’s a little more intuitive because it tells me how much we grew from a year ago.

Looking at the year over year data smoothes out some of the noise like the abysmal first quarter that we endured due to the cold weather, and the snap-back that occurred as people thawed out and went shopping again.

That low growth rate is consistent with the rest of the recovery, which is painfully less than previous recoveries. A few years ago, there was a lot of discussion about whether this would be a ‘V-shaped’ recovery (like first and second quarter) or a ‘U-shaped’ recovery, which implied a slower, more depressed recovery. Clearly, we’re in the latter category.

That said, our growth looks enviable compared to the rest of the world at this point (except in China, when policy makers get worried about growth that’s less than seven percent). Growth in the Eurozone is 0.80 percent and was -0.1 percent in the second quarter (both data points are through the second quarter).

The GDP report helps reinforce the idea that the Federal Reserve was right to end their bond buying program yesterday because it does suggest that the economy is continuing on its lumbering, choppy, but still growing course.