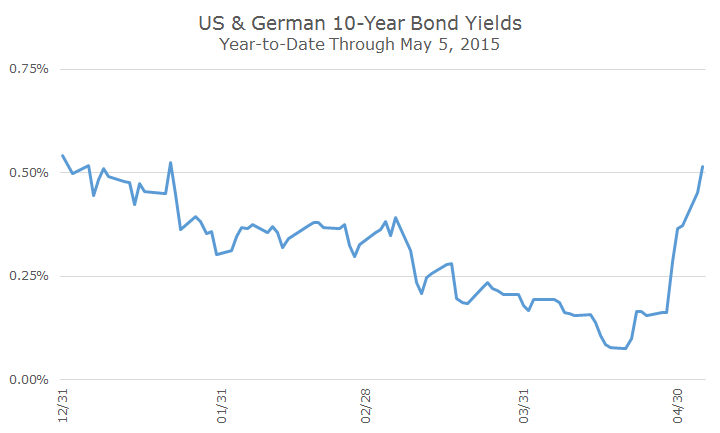

Yesterday, I wrote that Bill Gross, the former bond king, said that shorting German bonds was the short of a lifetime.

Although I didn’t have my nice chart (which I’ve added below), I did note that German yields had spiked, which means prices fell and his short must be working out well. I also went through the details of a short trade, so if you missed it, you can click here.

Naturally, I was surprised to see a headline on Bloomberg that read, ‘Gross’s ‘Short of a Lifetime’ Sours as Bund Slump Turns Volatile.‘

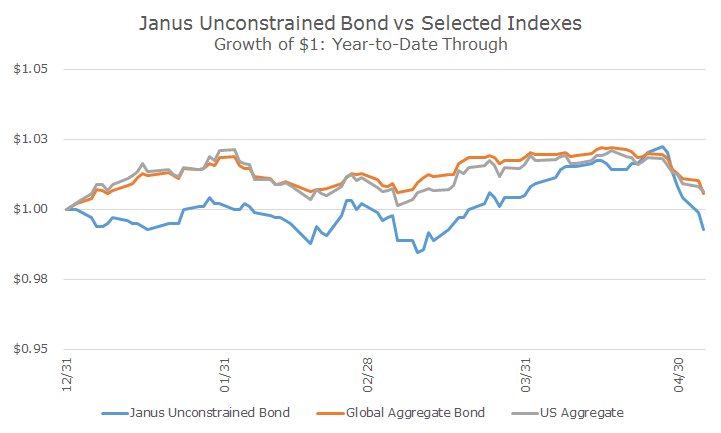

The first thing I did was pull up the year-to-date performance of his current fund, the Janus Global Unconstrained Bond Fund (ticker: JUCIX, which I presume is pronounced, ‘juicy-x.’ Just kidding).

The performance so far this year is not good, but what’s really interesting is that about the time that German bund yields shot upwards, his fund fell much harder than either the Barclays US Aggregate, or the Barclays Global Aggregate, which tracks all of the taxable, investment grade bonds from around the world.

You would have thought that he would be profiting from the short of a lifetime since the idea really is working, but Bloomberg reports that he shorted German bonds using a combination of options.

Some of the options would earn a profit if German bond prices fell, but he used a different bet to pay for the options, which mean that if prices went too far, he’d lose out. In fact, prices fell further than his bet and trade that was meant to pay for the short ended up costing him all of the gain on the short and then some.

I’m not trying to give Bill a hard time, I am simply pointing out that having a great idea can be tough to implement. He was spot on with his idea and the timing, but the implementation was off the mark enough that he lost money while he should have been making money.

Of course, he no doubt has other trades in his fund – it is, after all, what’s known as an ‘unconstrained’ strategy, meaning that he can do absolutely anything and isn’t constrained by having to compare himself to a benchmark.

Unconstrained funds became all the rage a few years ago as investors worried about rising interest rates and wanted a way to profit from difficult market conditions.

Overall, unconstrained funds haven’t fared well on average compared to the simple Barclays US Aggregate. Data from Morningstar shows that for the five year period ending on April 30, unconstrained funds as a whole earned 3.0 percent while the Agg earned 4.12 percent.

What’s more, the unconstrained funds have been about 25 percent more volatile than the Agg, which means that the risk-adjusted results were even worse.

We haven’t invested in any unconstrained bond funds at this point and I think that we will probably always stick with their contained brethren. The story of profiting in all market conditions is a good one, but it seems like they should have started with the conditions we’ve had over the past five years.

Maybe their day will come, it’s hard to say. In the meantime, we’ll continue with our constrained approach even though it doesn’t sound nearly as good.