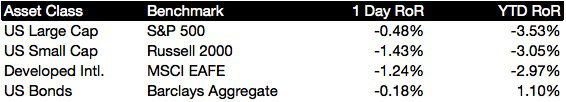

Stock markets fell and bonds rose sharply yesterday as the Federal Reserve continued to pull back on their quantitative easing program and tensions about emerging markets ramped up.

The yield on the 10-year Treasury dropped eight basis points to 2.69 percent, falling all the way from 3.0 percent at the start of the year.

Even though January isn’t even over, the Barclays US Aggregate bond index has regained almost three-quarters of what was lost in 2013 and the trailing 12-month return is now positive by four basis points.

As expected, the Fed announced that they would reduce their monthly bond-buying program from $75 billion to $65 billion.

In the last meeting, outgoing Chairman Ben Bernanke said that the Fed would take ‘further modest steps,’ which the market interpreted as $10 billion per meeting; a viewpoint that was solidified by today’s announcement.

The $10 billion level was clearly expected, but there was some uncertainty due to last month’s weak jobs report and the relative turmoil in emerging markets. By continuing to wind down the program, the Fed appears willing to accept some negative reaction to their changing policy, which is important information.

In their statement, the Fed provides five markers that indicate when the might start raising interest rates, none of which changed in the statement today.

Yesterday was Ben Bernanke’s last meeting and Janet Yellen takes over as Chairman on February 1, this Saturday.

Perhaps as a parting gift to Bernanke, today’s decision marked the first time that all of the voting members unanimously agreed with the policy decision for two and a half years.

With the end of Bernanke’s chairmanship, it’s natural to assess his performance. The other day, I read an opinion piece in the Wall Street Journal and while I didn’t agree with a number of the opinions expressed, the author said that Bernanke should be assessed on three time periods: before the crisis, during the crisis and after the crisis.

In my view, Bernanke’s time as chairman before the crisis is so brief, it’s hard to draw any conclusions. He assumed his role in February 2006 and the subprime meltdown occurred in 2007. Many people fault him, and the rest of the Fed, for failing to see the meltdown in advance, but I never though he or anyone else was clairvoyant.

During the crisis, I think Bernanke deserves the highest marks possible. Saying otherwise strikes me as a civilian criticizing a soldier about their moment-to-moment decisions after the battle is over, which is a disgrace.

Now, we’ll never know how close we were to a second Great Depression and I’m fine with that. I think we were close enough and I appreciate, Bernanke, Sheila Bair, Hank Paulson, Tim Geithner and the other policy makers who did the best they could in the heat of the moment.

Judging Bernanke after the crisis is harder. I tend to think that it’s too soon to judge and that we’ll have to let some time pass to really assess how Bernanke and his massively unconventional policies fared.

At this moment, I would give him high marks, but given that we’re just beginning to unwind quantitative easing, it’s simply too soon to say.

While we wait, let’s take a moment to welcome Janet Yellen!