Even though I was out of town last week on vacation, I generally keep my ear to the ground for market news and last week that was especially true because the Fed was expected to move one step closer to raising interest rates.

For at least a year, the Fed has maintained that they would be ‘patient’ about the timing of raising rates. I assumed, like most people, that the Fed would drop ‘patient’ and even though it was widely expected, that markets would drop on the news.

Although dropping ‘patient’ was anticipated, there were a few market participants who are worried about the impact of higher rates and are nervous about any steps towards that process.

Just last week, Ray Dalio, founder of the world’s largest hedge fund, warned that raising rates now could lead to a 1937-style market slump (click here for the Financial Times article, although a subscription may be required).

While I had heard that the Fed did indeed drop the word ‘patient,’ I didn’t see how markets responded for a few hours and was very surprised to see both stocks and bonds rally.

It turns out that markets were very happy to see a new signal from the Fed in the so called ‘dot plot.’

The dot plot is a chart that shows independent forecasts from each Fed official regarding economic growth, unemployment and interest rates.

In this meeting, the Fed officials all lowered their growth and unemployment forecasts, as expected, but the big news is that they all lowered their interest rate forecasts as well, proving more information about their expected pace of rate hikes.

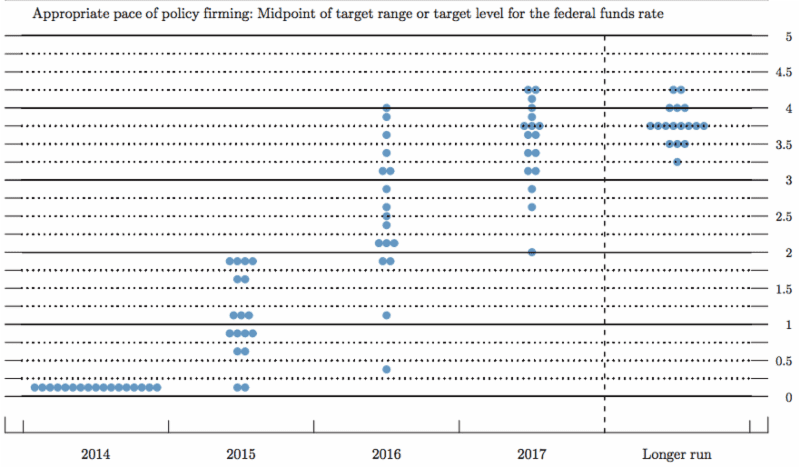

Here’s an image of the previous plot from six months ago, the December 17, 2014 meeting.

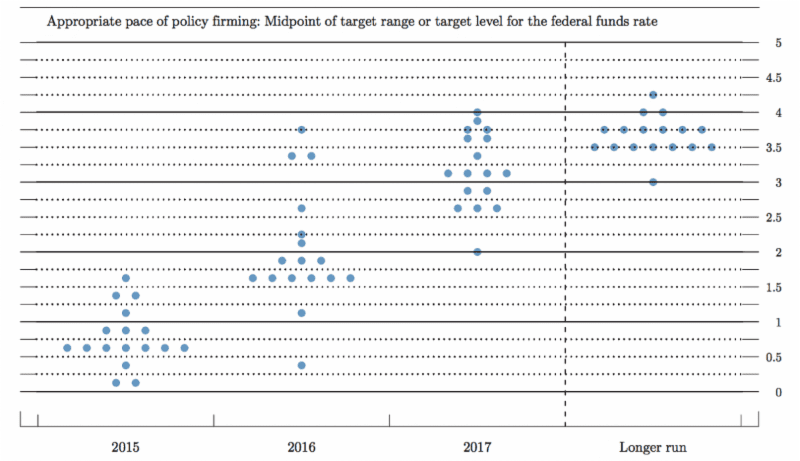

Now compare that to the dot plot from the meeting last week.

When you look at the December plot, you can see that the Fed official’s median forecast for the end of 2015 for interest rates was 1.125 percent. The current median forecast is now 0.625 percent, signaling lower expected interest rates this year.

That same message applies to 2016, which went from 2.5 percent to 1.875 percent, the following year, 2017, where estimates fell from 3.625 percent from 3.125 percent and for the ‘longer run, which saw estimates fall from 3.75 percent to 3.625 percent.

So, we no longer have a word to hang onto, like ‘patient,’ or a phrase like ‘considerable time.’ The Fed has succeeded in getting us off of the forward guidance, but I would say that markets are as hooked as ever, but this time on the dot plot.