Last week, I wrote that the recent changes in bond yields were nothing more than volatility. That’s true, but the increase in volatility has been unusually high in Europe.

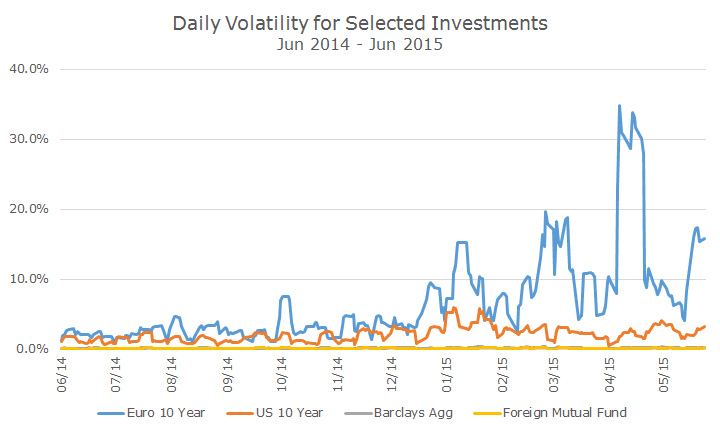

To help visualize the volatility, I charted the rolling five day volatility of the 10-year note in the US and the Eurozone (which is 100 percent correlated to the German 10-year bond).

The blue, and most dramatic line, reflects the yield volatility for the Eurozone 10-year note and the increase in volatility is obvious. The orange line represents the US and you can see that volatility here is largely unchanged, which is a little bit of a relief.

In recent weeks, there have been dozens of articles all over the financial press to explain the current volatility and one of the most credible answers is that bond markets are just not as liquid today as they were in the past.

Check out this Google Trends analysis of the term ‘bond market liquidity’ from all news sources – it’s shooting up faster than the 10-year German bond yield. It makes sense that the term popped up in 2008 when credit markets dried up and in 2011 when the Greek situation first blew up, but it’s interesting to see how the story has come back and dwarfed the old occurrences.

One of the most credible explanations for the lack of liquidity is directly related to the law of unintended consequences in my opinion.

After the 2008 financial crisis when all parties were guilty (lenders, borrowers, investors, regulators and the rest of government), the government created a number of new laws to reign in Wall Street. I can appreciate why people were so mad, but the new regulation has pushed a lot of large institutions out of trading and fewer large participants means more volatility.

I have no interest in creating a political firestorm, so I am definitely not taking sides on whether this was right or wrong, I’m simply saying that when you force large, experienced traders out of the market only two things can happen: either new entrants come to replace them or the nature of the market changes and becomes less liquid and more volatile.

Ironically, both of those conditions have the potential to make trading more profitable and if banks aren’t participating, then hedge funds and other players will. I doubt that the government was trying to help hedge funds when they crafted the law.

Now, that’s not to say that all of the illiquidity and related volatility is due to the new regulatory regime. Certainly, the European Central Bank (ECB) bond buying program is having a large impact on European bond liquidity, which is part of the idea behind the program – an aggressive buyer should push prices higher, which in turn, forces yields lower.

Also, there is a lot of new innovation in bond markets. During the 2008 financial crisis, bond exchange traded funds (ETFs) were new and didn’t command the assets that they do today. ETFs have the interesting impact of increasing liquidity for some bonds while reducing it for other bonds.

Imagine a world with just 1,000 bonds. If 100 of them are in an index with an active ETF, you end up with 100 bonds that are far more liquid and 900 bonds that are far less liquid. That was always true to some extent, but I think the proliferation of tradable bond products makes it more true today.

While the terms ‘volatility’ and ‘illiquid’ aren’t what you want to hear when you think of your bond portfolio, you shouldn’t be overly worried either in my opinion.

In the chart above, I slipped in the rolling volatility for the Barclays Aggregate Bond index and the primary bond mutual fund that we use for global exposure and you can barely see them. There is a little bit of volatility, but it’s so small compared to the yield changes, they look like zero. In fact, there has been a little, but it’s unchanged over the last year.

That comparison isn’t entirely fair for a few reasons, but mainly because the movement in yield is much bigger than the movement in price. The idea that I want to get across, though, that is entirely fair, is that the bond market volatility headlines isn’t necessarily translating into a lot of volatility in your bond portfolio.

Of course, we may get more volatility in the future, it’s impossible to say. We might also get more odd price movements like last fall’s ‘flash crash’ in bonds yields. I wrote about it in more detail here, but basically, yields plunged and prices spiked for a few minutes for reasons that no one can really explain.

The volatility may even turn out to be a benefit for investors like us. If prices get out of whack, it may be possible to buy long-term investments at cheap prices.

During the 2008 financial crisis, the net asset value of some ETFs were materially higher than the market prices. It was a buy opportunity, although we mostly missed it because we weren’t confident enough about the product at that time. Now, I think we’d be more likely to pounce on short term price blips that are in our favor.

As always, we’ve got our eyes on the ever-changing market place trying to understand the risks and hopefully ferret out opportunities. In the meantime, regulators are looking into the ‘increasingly brittle’ bond markets. Who knows, maybe they’ll actually fix it this time, although I won’t be holding my breath.