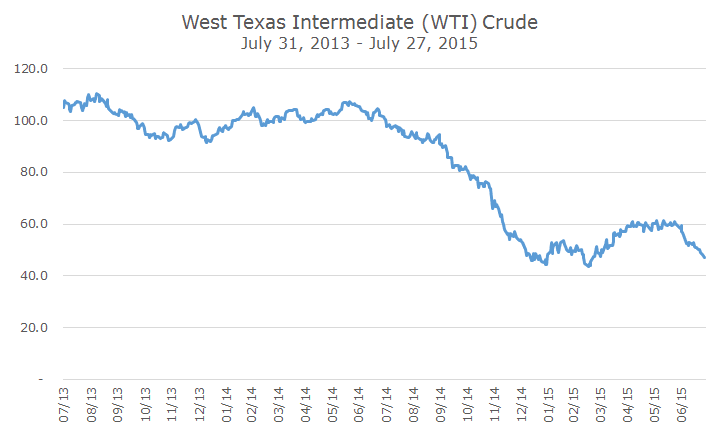

Oil entered another bear market after falling approximately 21 percent from the recent high in May, although you can see that the current bear market for oil is nothing like the one that occurred at the end of last year.

The rout in Chinse stocks is partly to blame because China is the world’s largest oil importer and second largest oil consuming country and an economic slowdown would further cut global demand at a time when production is near multi-decade highs.

In addition to the China story, oil prices are falling on the recent anti-nuclear deal with Iran. According to Goldman Sachs research, it will take at least two years for Iran to get half of their capacity back online, but the threat of more supply is weighing on markets since OPEC still hasn’t cut supplies.

Just last Friday, the oil services firm Baker Hughes said that the number of oil drilling rigs increased by 21 rigs last week to 659 in the US. That’s well below the peak in October of last year when 1,609 rigs were in operation, but up from the low of 628 rigs set in June.

As you might expect, energy stocks are taking it on the chin. So far this year, the S&P 500 Energy Sector index is down -12.9 percent through yesterday and is down -29.8 percent since its peak in June 2014 through yesterday. That’s right, energy stocks are in a deep bear market.

Energy stocks are adapting to lower prices with layoffs and expected asset sales, according to the Wall Street Journal. They report that 50,000 energy jobs were cut in the last three months bringing the total laid off in the sector to 100,000. It isn’t just the roughnecks that are getting cut either, now scientists and engineers are getting pink slips.

The question, of course, is not just what happens to oil prices from here, but whether their fall is signaling something about the economy that could, in turn, inform a decision making about our portfolio.

Ultimately, it’s too difficult to answer. There is a link between falling oil prices and a slowing economy, but it’s more typical that recessions follow big spikes in energy prices, not big declines.

Also, there is nothing new about slow global growth. We’ve been dealing with that since the 2008 financial crisis. Perhaps we should have viewed the slow growth over the past five years as a signal that oil prices would drop.

Ultimately, oil is simply far too volatile to create a useful signal. Remember that it’s so volatile that it is excluded from core inflation readings.

When looking for a signal, you have to be able to distinguish it from the noise and unfortunately, oil prices are so noisy that it is not possible to identify a signal.

In any case, I’ll just keep enjoying low prices at the pump. Right now, it costs a little less than $2.50 a gallon to fill up, which is greatly appreciated.