Well, we’ve got at least a few more months of the Fed’s ongoing ‘will they or won’t they’ drama about when they will raise short-term interest rates.

Although markets did not expect a rate increase, it’s really impossible to know until the announcement because it really boils down to the judgment of the 12 Federal Open Market Committee (FOMC) members.

You might think we don’t know anything more than we did the day before, but that’s not quite true because we’ve got the official statement to obsess over and there is some new commentary that investors are highly focused on, most notably:

“Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term.”

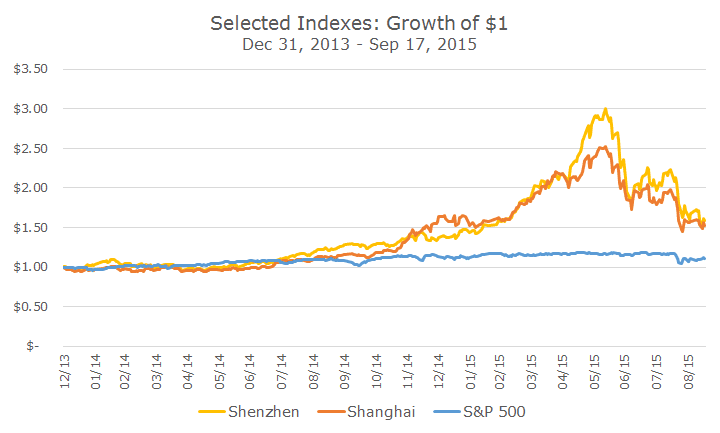

Since the Greek situation has been going on for years, they must almost certainly be referring to the economic slowdown and financial market bubble burst in China.

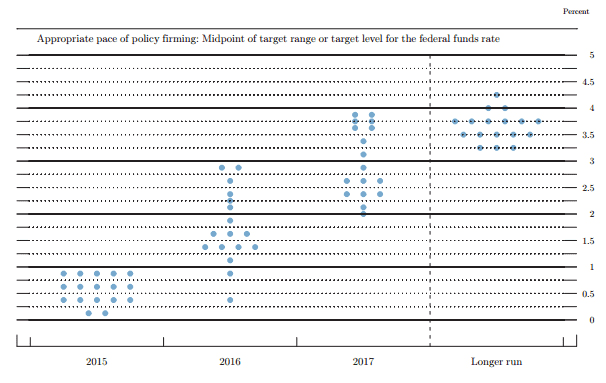

One of the useful tools to come out of the Fed meetings is called the ‘dot plot,’ which shows the point estimates for the federal funds target rate from the FOMC members (voting and non-voting).

Let’s look at June’s dot plot:

We can see that two members thought that rates should stay where they are (as seen by the bottom two dots on the left hand side) by the end of 2015, while the remaining 15 members thought that rates would range from 0.25 to 0.75 percent.

Back in June, most members thought that rates would be between one and three percent in 2016, and two and four percent in 2017. In the more nebulously titled ‘longer run,’ most members think that fed funds rate will be between 3.25 and 4.25 percent.

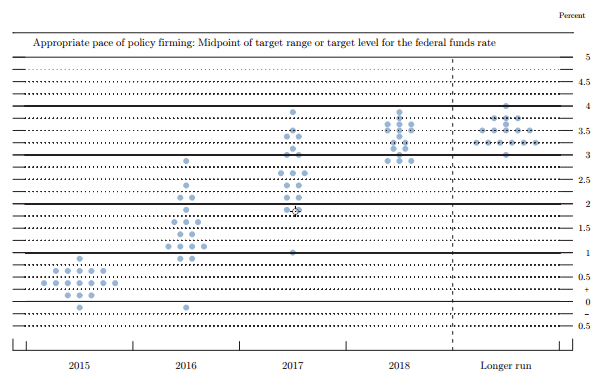

Now let’s take a look at the current dot plot and see how their views have changed in recent months.

Over the rest of 2015, most members shifted their assessment that rates would fall downward and one member thinks that they ought to be negative, which implies a reintroduction of the old bond-buying program that was wrapped up last year.

In 2016, there were still some members who think that rates could be as high as three percent, but there are a bunch now below one percent (including the one negative nelly) and the tenor is clearly lower.

The forecasts for 2017 are not radically different and now we have new information: estimates for 2018, which show that the members think that we’ll be near the ‘longer run’ estimates. The longer run estimates are a little lower now across the board, which is also worth noting.

In the press conference, Chair Yellen said that a ‘great majority’ of the members think that there will be a rate hike this year.

Although Yellen said that October is on the table, most market participants think that they will wait until December when there is another press conference, so that they she can explain their actions.

The dovish new dot plot suggest that even if they do raise later this year that the slogan ‘lower for longer’ is definitely still in play.