While markets were obviously down, one piece of good news is that they weren’t chaotic. You may think I’m grasping at straws here for a silver lining, but wild macro events can cause markets to get sloppy and that didn’t happen Friday.

Last August, when markets were selling off, the heavy trading volume caused a number of stocks and ETFs to behave erratically in what some people described as a mini-flash crash.

For example, back in August, the Guggenheim S&P 500 Equal Weight ETF fell by more than 40 percent, while the value of the underlying securities only dropped by six percent.

Losing six percent is bad enough, but the market dysfunction magnified the loss by six fold for a short time period. It wasn’t just Guggenheim either, 303 ETFs were affected along with 471 stocks (for more details, click here).

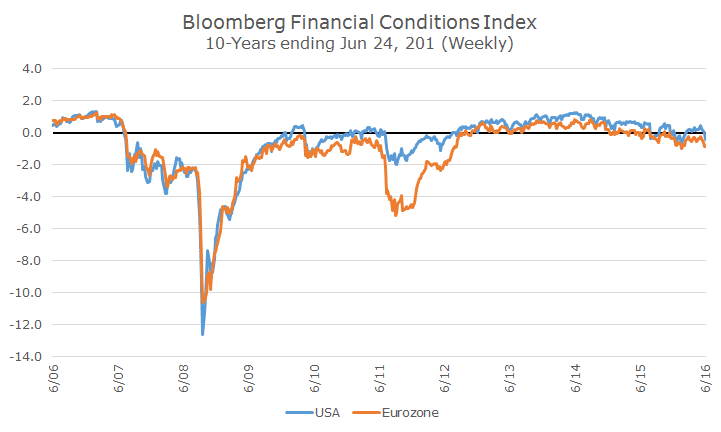

In addition to ‘normal’ trading on Friday, I checked out the Bloomberg Financial Conditions indexes, which try to measure the stress on the overall system by looking at bond and money market levels and spreads among other things.

What you can see from the chart above is that while conditions are worse now than they were a year ago, we’re definitely still in ‘normal’ territory – nothing like what we were seeing in the middle of 2007 before the stock market peaked, or 2008, when the market was crashing or even 2011, when the sovereign debt crisis was at its peak.

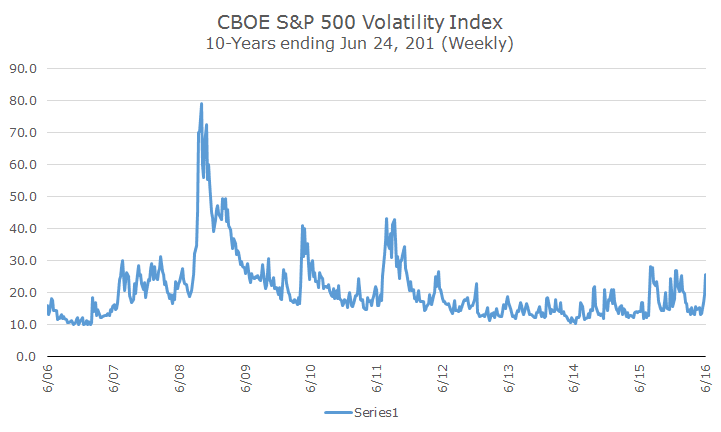

I also looked at the expected volatility for the S&P 500 based on options pricing at the Chicago Board of Options Exchange (CBOE). You can definitely see the spike last week, but it takes us to the levels that we saw last fall and in the first month and a half of his year.

I’m definitely not saying that everything is hunky-dory by ignoring the storm cloud while looking at the silver lining. I simply want to point out that in some ways that this is normal.

Looking at the VIX chart, you can see that volatility was unusually low during the period of 2012-2015. I wrote an article to that effect back when volatility was low (click here for the article) and wondered how we would all respond to volatility when it came back (it always does).

So far, I’ve been pretty impressed with our client base, starting with the correction last fall, continuing into the first month and a half of this year and now, with one of the biggest shifts in British foreign policy in 70 years.

We didn’t, and couldn’t have, predicted any of the three sharp corrections or the two rallies that followed the last two declines. This one isn’t quite as bad of a drop because of the strong rally in the days leading up to the Brexit.

I also believe that the market response was an over-reaction, although I’m mostly referring to the impact on Britain; perhaps the market is pricing in a greater existential threat to the whole Eurozone project. It’s hard to say. I don’t have anything to point to here but a gut feeling, which is something that I don’t particularly trust even when it’s my own (substantial) gut.

Naturally, I’m hopeful that we get a quick rebound like we did on the last two corrections, but that may be too much to ask for at this point – the election is over, but that’s just the first step into uncertainty.

There will be many twists and turns as everyone figures out how the British can extricate themselves from the European Union. There is no precedent to follow and Britain isn’t just some member: in 2015, it was the second largest economy by nominal GDP.

The good news in this regard is that they hadn’t adopted the euro, but still, it’s going to be an effort to get out. While this process will certainly bring additional market volatility, it will also subside in the face of new events that affect prices.

As always, we’ll continue to monitor what is going on and make sure that we are doing our best to try and earn reasonable returns while taking acceptable risks.