Warren Buffett is rightly considered the most successful investor of all-time. Not only has his holding company, Berkshire Hathaway, grown at a much higher rate than the overall market, he’s managed to earn exceptional returns for much longer than others who have also earned high returns.

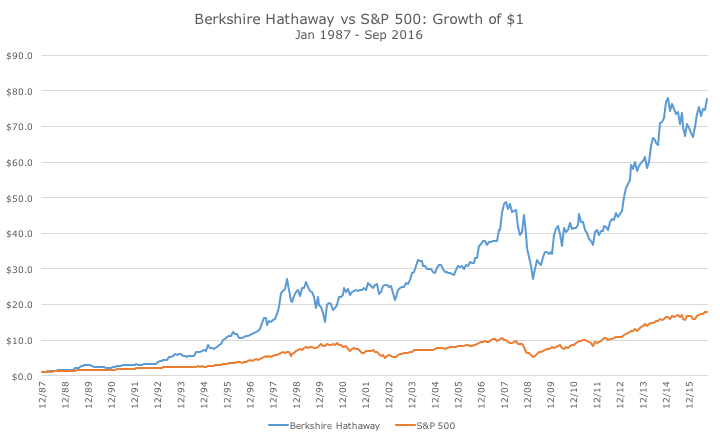

I was only able to pull data from 1987, but the last 29 years have been extraordinary for Buffett and his fellow shareholders. Over this period, Berkshire earned 16.1 percent while the S&500 earned 10.53 percent.

One dollar invested in the S&P 500 would have grown to $17.92, which is pretty terrific, except when compared to what $1 would have earned in Berkshire, which would have grown to $74.56.

When pulling those numbers, I was a little surprised to discover that Berkshire stock was 50 percent more volatile than the S&P 500 over this time period, with an annualized volatility of 24.45 percent compared to 15.93 percent for the S&P 500.

I shouldn’t have been too surprised, since Berkshire is just one stock, while the S&P 500 is a diversified index of 500 companies.

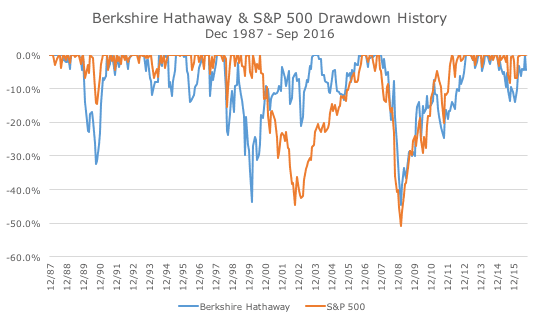

It occurred to me that the higher volatility that Berkshire endured would have resulted in higher drawdowns as well. The chart below shows the drawdown history of the two and the results are interesting.

While both fell about the same amount in the 2008 financial crisis, when Buffett famously wrote that he was busy buying stocks, I was interested to see how the two compared during the tech wreck.

Notice how Berkshire fell substantially in the late 1990s during the bubble period for the S&P 500. I can’t say that I was paying attention to Berkshire back then (although I should have been), but think of how difficult it would have been to be a Berkshire shareholder and be down 40 percent from the recent high while the S&P 500 was roaring.

If you had managed to stay invested, your Berkshire stock recovered nicely while the S&P 500 fell, but it would have been difficult to stay disciplined.

Also, notice the decline in the late 1980s and early 1990s. When the S&P 500 fell about 15 percent, Berkshire was down more than 30 percent. Over the next eight years, Berkshire had four drawdowns of more than 10 percent while the S&P 500 never fell that much.

In short, owning Berkshire over the last 29 years wasn’t always easy, despite the mega-returns. When you look at the final results, it looks like a piece of cake, but it was a bumpy ride for several extended periods, especially if you were worried about how much you deviated from the S&P 500.

During the 10 percent correction in January and February this year, one market prognosticator asked, ‘Do you think Warren Buffett is worried about this decline?’

Of course, anyone listening knew instantly that Buffett was not worried, even though he was largely silent at the time because he knows that even the most successful investing takes time and goes through rough patches.