Although some of the weakness was thought to be technical in nature, it is also the latest chapter in an ongoing tough market for bonds amid rising inflation expectations, a reasonably strong macro-outlook, solid corporate earnings, improving covid trends, and expectations for continued fiscal stimulus.

Only energy posted a win for the week, up 4.3 percent. Utilities and consumer discretionary stocks were down -5.0 percent respectively, and technology fell by -4.0 percent (which is a signal that the stock selloff wasn’t entirely bond-related).

Although there were a variety of factors that pushed interest rates higher, chief among them is higher inflation expectations.

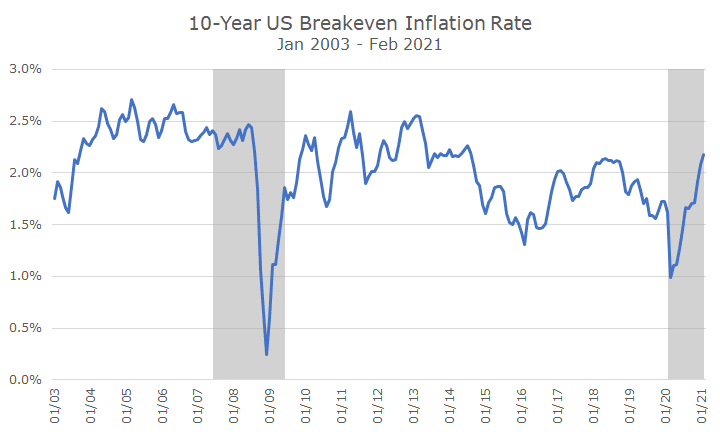

No one can predict the future of inflation rates, but there is a way to measure what the markets think inflation will be by looking at the interest rate differential between standard and inflation-linked Treasury bonds. This difference, called the breakeven rate, signals what investors in the aggregate think inflation will be in the future.

The chart below shows the breakeven rate for the last 18 years, which is as far as this data goes since inflation-protected bonds are relatively new. This data, from the St. Louis Federal Reserve, also highlights the two recessions during this period in gray.

Broadly speaking, the chart shows a few things. First, inflation expectations have generally fallen during this time. In my opinion, that’s largely a function of low economic growth expectations, but it’s hard to prove.

Second, you can see that during recessions, there are sharp drops in inflation expectations, which are also probably related to fears over low economic growth.

Third, you can see that inflation expectations have increased sharply since their lows a year ago, partly as investors could see that we would pull through the pandemic as we figured out how to live with it, developed a vaccine, and the government announced massive monetary and fiscal stimulus.

What you don’t see from this chart are out of this world inflation expectations, like what you might see in Zimbabwe, Brazil, or the Weimar Republic.

A lot of people worried that we might get a lot of inflation (even if it wasn’t hyper-inflation) in the wake of the monetary policy coming out of 2008, but it never happened. This time may be different, but it may not – we don’t know.

So far, the market thinks that inflation over the next decade will be around 2.0 and 2.5 percent, which seems pretty manageable.

The Federal Reserve spent a lot of time and energy trying to get inflation expectations over two percent coming out of the 2008 financial crisis but struggled to do so.

Some clients are asking what we are doing to protect ourselves from higher inflation rates, and it’s a great question.

The Investment Committee has investigated a lot of choices, but it’s complicated. Next week, I’ll address the primary options we’ve considered, and the pros and cons of each strategy.