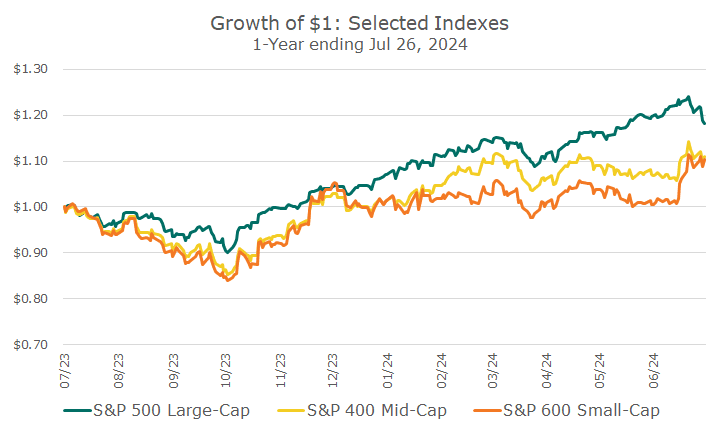

Take a look at small cap returns last week!

Since July 9th, small-cap stocks have risen by about 10 percent, a remarkable run of 16 trading days. Better still, the S&P 500 fell during that time, highlighting the diversification aspect of small caps.

One of the pillars of factor investing is that small-cap stocks should outperform large-cap stocks, a phenomenon known as the size premium.

From an academic standpoint, there is some controversy about whether the size premium exists. The premium is smaller than other factor premiums like value and momentum, and it’s volatile, so the evidence is weaker.

Some people argue about the way the premium is constructed, and others claim that small-cap ‘works’ if you control for the quality of the stocks.

I’m unsure whether the premium exists, but I still think it’s an important allocation and even worth an overweight compared to the overall market.

First, I believe the story is that small-cap works if you control for quality, and we use funds to do that. Over the last decade, the index we track that controls for quality has outperformed the more conventional benchmark by a little more than one percentage point per annum.

However, both the quality-controlled and the uncontrolled small-cap indexes underperformed large-cap in the same decade. I think that has to do with the fact that the S&P 500 became very expensive at that time.

Ten years ago, the forward price-earnings ratio on the S&P 500 was 16.8, and now it’s 22.6. That may not sound like much at first blush, but it’s a 34 percent increase, which is very meaningful.

The opposite occurred with the S&P 600 small-cap index. Ten years ago, the forward price-earnings ratio was 21.7. Today, it’s 16.8, a contraction of 22 percent.

I don’t know where valuations will go from here (let alone the underlying earnings), but I’d be willing to bet on some mean reversion and that the S&P 500 will get cheaper while the S&P 600 small-cap index gets more expensive.

That may not come to pass, and I’ll be all right with that, too, partly because I’m uncomfortable with the degree of concentration in the S&P 500 – both in terms of the ten largest stocks and from a sector perspective.

The top ten holdings in the S&P 500 are a whopping one-third of the index, but in small-caps, the ten largest stocks are less than six percent. Technology stocks are 10.2 percent of the small-cap index and represent 30 percent of the S&P 500.

There’s also a lot of evidence that factor exposures besides quality work better in small caps, meaning that you’re more likely to get the value premium (cheap versus expensive stocks) or benefit from momentum in small caps than in large caps.

I’ve heard many times about the rally that you must be present to capture the premium, meaning you can’t time factor results in the same way you can’t time the market. I don’t think anyone saw this rally coming, which is more evidence for the concept.

I don’t know whether the last few weeks reflect the beginning of some kind of rotation or an aberration. But since we are overweight small-cap stocks, I’m happy either way.