Last week, I talked to a client who said something like, “My bonds aren’t doing well because yields are going up, but the Fed just cut rates. I don’t understand.”

I can understand, and the answer is that the industry is lazy when discussing yields and rates.

Let’s start at the beginning, though. The first part of the statement states that bonds aren’t doing well because the yields are going up. That’s been true since about mid-September.

In mid-September, the bond market, as measured by the Bloomberg Aggregate bond index, was up more than four percent year-to-date. Since then, most gains have eroded, and the index is now up 1.5 percent for the year.

The simple thing to remember here is that yields up = prices down and vice-versa.

Now the question is, what rates are we talking about? It’s context-dependent, which is what I mean when I say the industry is lazy when talking about yields and rates.

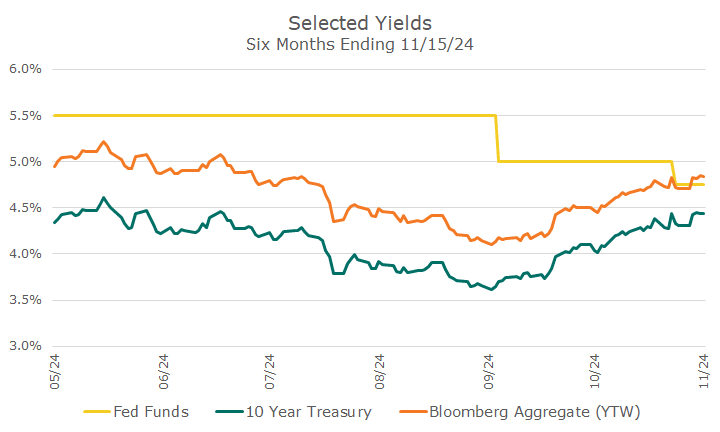

The chart below may help. It shows the yields on three things: the Fed Funds rate, the 10-year Treasury, and the Bloomberg Aggregate (shown as the yield-to-worst, but that’s a long story).

The Fed Funds rate, in yellow, is the rate controlled by the Federal Reserve and voted on by the Federal Reserve Open Market Committee.

Rates were steady until the end of September when the Fed cut them by half a percent. It’s a little more difficult to see, but there is a second quarter-percent cut to the right. This is where we can say that rates fell.

The lines below in orange and green show that rates also rose. What’s important to understand is that these are different yields. The 10-year is just what it says: the 10-year Treasury note yield. The yield on the 10-year rose starting about when the Fed started cutting.

I don’t have an answer for why that’s happening right now- there are many theories but no real concrete answers. It’s unusual, but pretty rare.

More generally, the Fed Funds rate is a government rate, a tool for monetary policy. The markets, not the government, set the yield/price of the 10-year Treasury and the bonds in the aggregate index.

It makes sense to me that these rates would conflict periodically because the government and investors have different goals and objectives. At some point, we’ll have a better sense of why that conflict exists today, but in the meantime, I will try to be more careful about talking about what rates are moving.