For most of last week, I was in Boston at Schwab’s IMPACT conference – my fourteenth pilgrimage that includes prominent speakers, workshops and a football field size area of vendors pitching everything under the financial services sun.

This year featured more academics than usual, which I found particularly engaging. One of the sessions was actually a debate between academic Roger Ibbotson (who also manages some money) and Rob Arnott, a practitioner with some academic credentials as the former editor of the Journal of Portfolio Management and the author of a number of papers.

The debate was good, although the real highlight for me was during the audience Q&A when someone asked Rob Arnott how much of his personal net worth was invested in emerging markets stocks.

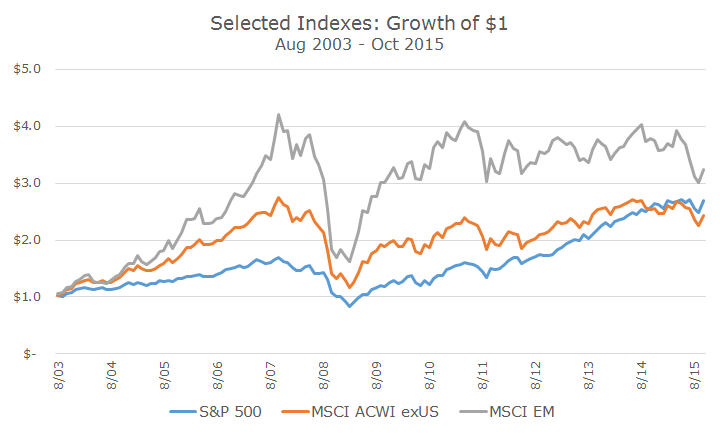

This is an interesting question for two reasons. First, Arnott has been saying that emerging markets are a great value for a while now and they keep heading lower. With the double digit decline this year, he said at the conference that he is now pounding the table that emerging markets are a screaming buy if you’ve got a 10-year time horizon (which, in theory, we all should).

The time horizon selected is based on when we formed Acropolis. The MSCI ACWI exUS is the entire world, developed and emerging, outside the US. The MSCI EM represents just emerging markets.

Second, the question is good because it asks the question the right way. In the last issue of Portfolio Insights, I included a quote that Chris found from finance author Nissim Taleb who said, ‘Never ask anyone for their opinion, forecast or recommendation. Just ask them what they have or don’t have in their portfolio.’

Arnott responded by saying that he now has one-third of his net worth in emerging markets stocks, which is a big time wager. Emerging markets stocks account for about 15 percent of the world’s market capitalization, so Arnott has a huge relative bet on them. I would never make that kind of bet, but I admire that he’s put his money where his mouth is.

His firm produces 10-year forecasts for a variety of asset classes (which you can find here) and emerging market stocks have the best outlook using their methodology.

They believe that the MSCI Emerging Markets index will earn 7.9 percent after inflation. That’s much better than other developed stocks, which they predict will earn 5.3 percent net of inflation and just 1.1 percent real for the S&P 500. If he’s right, that wager will pay off in spades.

I share the view that emerging markets will likely do better than developed markets in the coming decade, but I’m not confident enough to make that kind of wager with your money or mine. I’ve got five percent of my portfolio in emerging markets, which is what we recommend for clients with a 100 percent stock allocation.

A big bet for me would be to bump the allocation up to seven or eight percent and I may do that next year with new contributions. But I don’t have the confidence that Arnott has, which may or may not be a good thing – we’ll have to check back in 10 years and see how he fared and how he’s positioned then.