On Wednesday, I met with a client that I’ve worked with for more than 10 years. In fact, we signed the new account paperwork the night before my second daughter was born. As you might expect, my wife was not thrilled.

In the late 1980s, this couple made a substantial investment with an extremely well known investor – someone I grew up watching on Wall Street Week with Louis Rukeyser.

When they first showed me his performance numbers a number of years ago, I was flabbergasted by how good they were and I realized that the reputation was well earned.

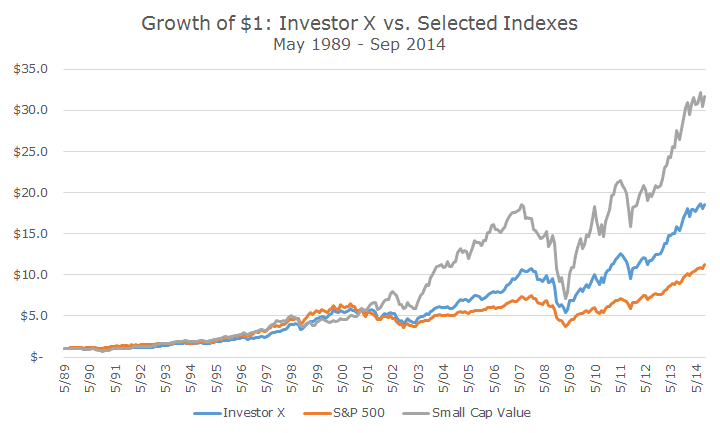

I don’t know what the numbers were at that time, but through the end of September this year, he’s up 12.02 percent per year since inception versus 9.94 percent for the S&P 500. Over a long period like this, the compounding is amazing: the cumulative return for the client is 1,729 percent versus 927 percent for the index of large cap stocks.

She showed me the statements during the meeting and I noticed that they are down -2.09 percent this year, compared to the positive 8.34 percent return for the S&P 500 over the same time period.

At that moment, I had a Eureka! moment – he’s a small cap investor! Glancing at the holdings, I recognized some of the companies, but most of them are mid cap companies. There were a few large cap stocks, but among the 80 or so holdings, a lot of them were fairly small companies.

Of course there is nothing wrong with small cap companies, we own a good deal of them through mutual funds and ETFs. But, it occurred to me that the outperformance might not be due to skill, but instead exposure to the classic factors that we talk about so frequently, like size, value and momentum.

Yesterday, I loaded the month returns into our software to see whether the results were explained by skill (alpha) or simple factor exposure that we can get with cheap index funds.

As it turns out, there’s a chance there may be some skill. Based on this data and using the Fama-French three factor model, there’s a roughly 50/50 chance that the 0.65 percent per year in return that the model doesn’t explain (the alpha) is skill.

Most of the return, 11.4 percent per year or so, can be explained by exposure to small, cheap companies, or size and value factors. When I watched some old Rukeyser videos on YouTube featuring this investor, he talks about buying cheap companies that are takeover targets – small and cheap stocks.

My clients earned it, but the statistical tests basically show that it’s 50/50 whether it was luck or skill. It may happen again, although since this investor is 72, the question is whether or not that skill will carry over to the next generation, especially since another test showed that there’s been no alpha over the last decade.

Now, let me be clear, I still admire this guy, Investor X. All the results that I am quoting are net of fees, so, presumably, there was more alpha that may have even been statistically significant.

Not only that, he started his firm in 1976, well before academia had figured out the factor premiums that we now rely on so heavily.

Back then, the term ‘small cap’ didn’t exist and the research in this area didn’t hit the ivory towers until 1980. The three factor model that I used to test these numbers didn’t exist until 1992. Value has been well known since the 1932 Graham & Dodd book, Security Analysis, of which this fellow is a proponent.

In short, he was a pioneer. Kudos to him for developing the ideas early and putting them in action for the benefit of his clients. And kudos to my clients for sticking with him over the years – there were some periods, like this year, where he didn’t look like the S&P 500 and a lot of people might have bailed out.

When I first saw his performance a few years ago, I didn’t think we could do as well for our clients and I was a little sad about it.

Now, I realize that we absolutely have the tools to earn these kinds of returns, although we wouldn’t ever put all of our eggs in one basket. We have small value exposure, but it isn’t the entire portfolio like it was for these clients, whether they realized it or not.