Since January, I’ve offered previews for the Investor Social, which we held last week to great success.

Mother nature threw us a little snow, but we still managed to pack the house and will need to find a larger venue next year, and put it online. In the meantime, we’ll provide the presentation to anyone that asks.

The highlight of the show for me is when we ask the audience what they think might happen in the coming year. I never know how the audience will respond and I think it’s fun to engage in a back-and-forth, live and in person.

So, without further ado, here are the results of the audience polls from last Monday’s Investor Social.

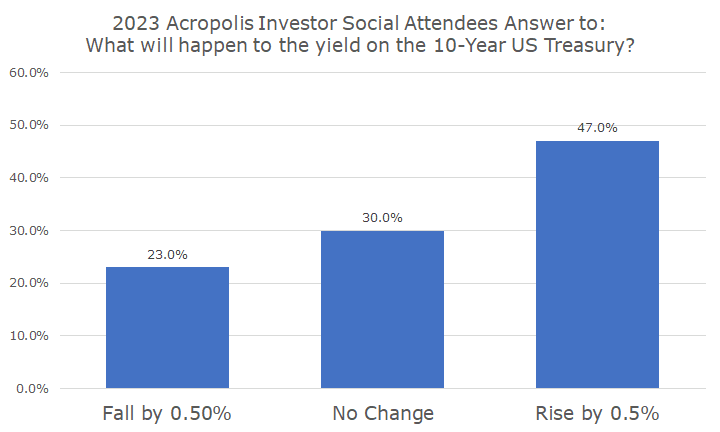

The first question is highly topical, given how much interest rates rose in 2022 on the 10-year US Treasury. The yield on the 10-year was 1.52 percent at the end of 2021 and shot all the way to 3.88 percent by the end of 2022.

Almost half of the respondents thought that interest rates would continue to rise in 2023, by more than 0.50 percent, for a yield somewhere north of 4.38 percent. As of Friday, the yield was 3.53 percent, which means that rates would have to climb 0.85 percent between now and year-end, which surely could happen!

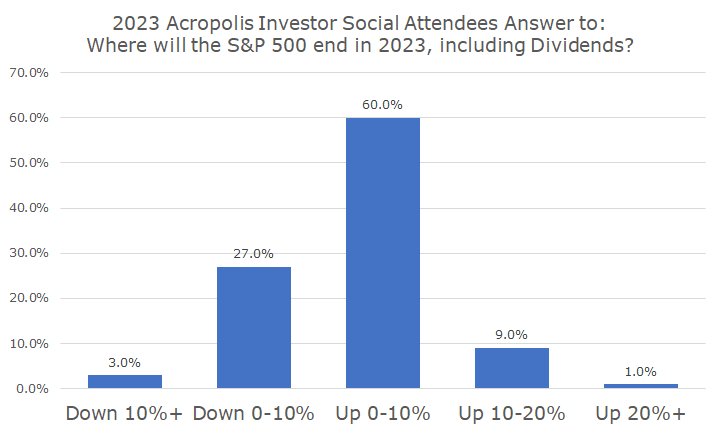

Most people feel better about their stock market predictions, and 60 percent of attendees thought that a return of somewhere between zero and 10 percent was a good estimate for 2023.

There were more bears than bulls, though with most of the other responses coming in with losses clients and just a few people expecting large returns from stocks in the coming year.

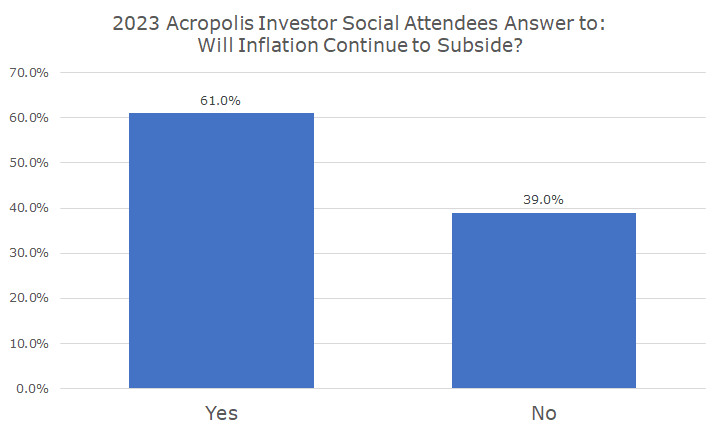

When asked if they thought inflation would continue to subside in 2023, about 60 percent thought that they would. Another 40 percent were more skeptical, thinking that inflation would likely remain persistent in the new year.

I wish that I hadn’t asked a leading question, but moreover, I wished that I had asked what ranges people expect. How many of the skeptics think that it’s just a little more or a full-blown repeat of the 1970s? I can’t say based on my question.

Lastly, I asked whether people were expecting an official recession in 2023, and the crowd was dour, with almost two-thirds of respondents saying that a recession is in the cards. That’s about the same percentage as professional economists, as measured by Bloomberg’s survey.

The event was a lot of fun despite the tough markets in 2022, and we hope that next year’s event is even more fun, hopefully with better results to report.

And one more thank you to the folks who worked incredibly hard to make the event a success, including Leslie Akers, Matt Binder, Kelli Bump, Mimi Rudolph, and Sakis Salas.