Although it’s come and gone, I am still thinking about the price spike in the 10-year US Treasury note that occurred last Wednesday.

Someone from Blackrock told me yesterday that it was the most volatile day for the 10-year since 1980, which implies that it was more volatile than 99.91 percent of all of those trading sessions.

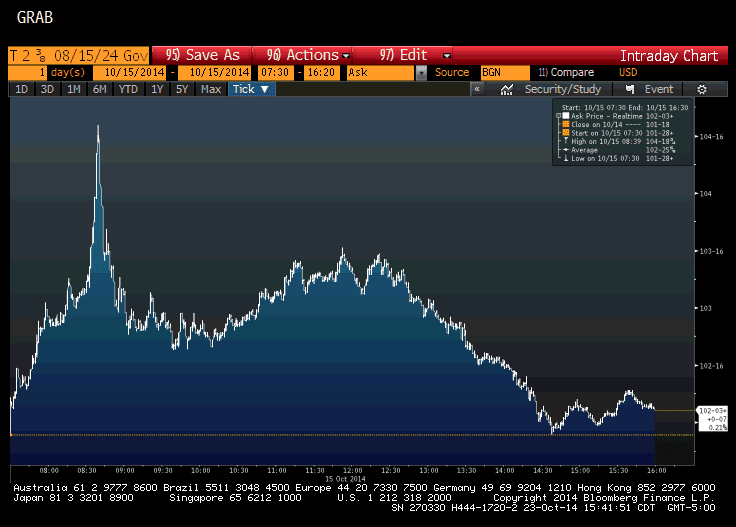

You can see from the chart that all of wilding was in the first hour of the day and that if you just look at the closing prices each day, you can’t tell that anything happened.

Although nobody knows with any certainty, most people (including me) think that this was a classic short squeeze. Not many people know what short squeeze is and attribute all kinds of market activity to them, including yesterday’s upward movement in the overall stock market, which I think is highly unlikely.

So, let’s start with a definition in the form of a story.

Let’s say that you are a hedge fund and think that the interest rate on the 10-year Treasury is too low and want to bet against that. Remember that the yield and the price on bonds move in opposite directions, so betting that yields will rise is equal to betting that the price will fall.

One way to express your view is to ‘sell short’ the 10-year Treasury, which means that you sell the bonds without actually owning them – you have to borrow them from someone else. If you’re right and prices fall (yields rise), then you can buy them back at a lower price, return the securities that you borrowed and pocket the difference.

It sounds complicated, I know, but essentially the process is selling high and buying low, instead of buying low and selling high.

If you’re wrong and prices actually rise, you’re going to lose money because you will have to buy the bonds back at a higher price than you sold them for earlier.

The process is further complicated if you’ve borrowed a lot of money to put on the trade. If the trade isn’t going your way, the person that lent you the money sees the value of their collateral going down and can force you to exit the trade when you don’t want to.

If you had just bought the bonds, that would mean selling them. But because you are short the bonds, you have to buy them back.

Unfortunately, the guy that loaned you the money is forcing you to exit the trade at any price to get out of it. If you’re big enough, and the rest of Wall Street sees blood in the water, everyone will raise prices because they know that you have to take it. That’s the squeeze.

Thankfully, we have almost no exposure to short selling and leverage, so you won’t find yourself in this kind of position anytime soon.

Interestingly, there were both winners and losers on this trade.

For the guys that were short and were forced to buy at unfavorable prices, there was undoubtedly a lot of profanity, stomach troubles and probably even a few jobs lost.

On the other side, though, there was no doubt a lot of cheering, exhilaration and people buying Ferrari cars with their bonus money.

In other words, it was just another day on Wall Street, but even more exaggerated than usual.