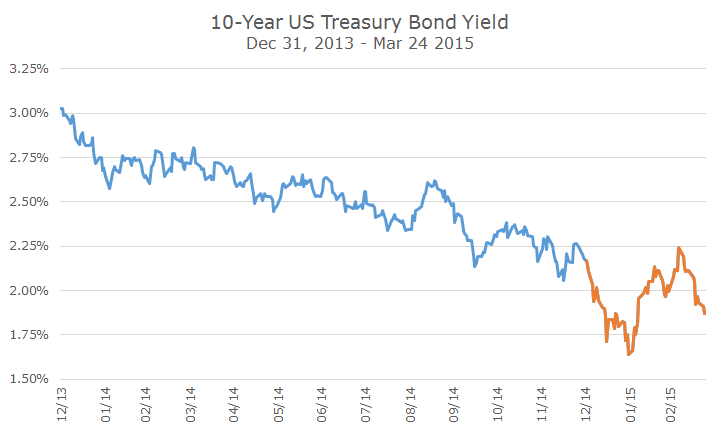

Last year, one of the big stories was falling yields. Much to everyone’s surprise the yield on the 10-year US Treasury note fell from an even three percent to 2.17 percent.

After falling sharply early this year into mid-January, yields started to rise and ultimately retraced their steps just a month later.

Just as people started to think, ‘Okay, this is it – now interest rates are going to rise,’ yields started to fall again.

The following chart plots the yield on the 10-year note last year, in blue, and this year, in orange to try and help illustrate what’s happening to yields.

It’s interesting to me that intermediate term rates (it’s the long end of intermediate term, for sure) are falling while short-term interest rates are widely expected to go up this year.

At this point, the futures markets have priced in a 47 percent probability that that ‘lift-off’ (bond-speak for when the Fed starts to raise rates) will be in September.

Markets think that there is only a seven percent chance of rates going up this summer and the remainder obviously point towards the winter or next year.

If the 10-year continues to fall as the Fed begins to raise short-term interest rates, there are a few things to consider.

First, it’s possible that the ‘shape’ of the curve changes. A normal yield curve has low yields in the short run that rise as the term of the bonds extend into the future.

A steep curve means that the difference between short and long term rates is high and a flat curve means that the difference between short and long term rates is low.

Another possibility, one that worries St. Louis Fed President James Bullard, is the Fed actually surprises markets and they respond in a ‘violent’ way. That seems unlikely, but it’s certainly a possibility.

When Bullard was asked to define what ‘violent’ meant, he said that it could be something like the taper tantrum in 2012 when the Barclays Aggregate bond index fell by -2.02 percent – violence in the bond market is something quite different than it is in the stock market.

Of course, it’s hard to know what will happen with yields from here. Personally, I hope they go higher – not because I want to see them lose value, but because earning two percent on a 10-year bond is for the birds!

As long as your time horizon is longer than your duration, you want yields to go up. Our portfolio duration is about five years on average and I hope for your sake that your time horizon is longer than that.