I’ve had the feeling recently that stocks were more volatile than usual. As funny as this may sound, I don’t trust my own gut at all. Despite its size, my gut is no better than anyone else’s at creating hunches that are worth a darn, so I turn to data frequently.

To address my intuition, I did a quick check of the average volatility for the first quarter compared to the average volatility of all of last year and found that, yes, markets were a little more volatile. I’m not giving my gut any credit, though, that’s called luck.

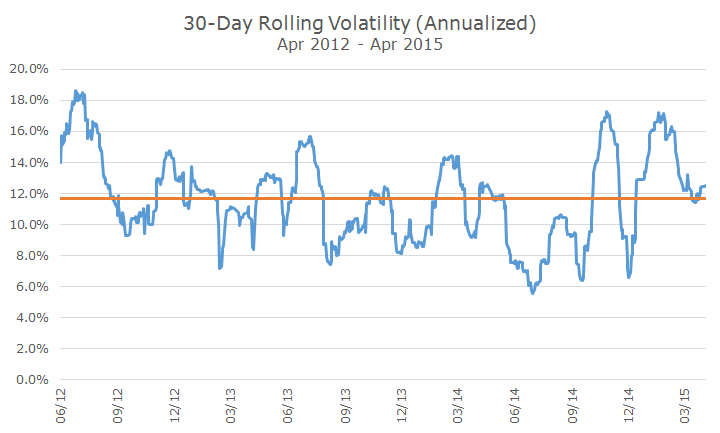

Then I decided to look at the realized volatility on a 30-day rolling basis. This is nice because it catches data from every day of the year and you really can get a picture of changes in volatility over short periods of time.

The blue line is the rolling 30-day volatility and you can see that it has shifted around some in the last three years, and has averaged about 12 percent, as indicated by the orange line.

In the last 30-days, volatility was pretty much average compared to the last three years, so my gut was sending me a false signal (it could have been hunger).

As I looked at the average volatility of about 12 percent, I couldn’t help go back to one of my earlier messages, which is that not only have returns been good in the last six years, but volatility has been surprisingly low.

When you look at the entire data set of stock returns going back to 1926, the average annualized volatility is about 18 percent, so our 12 percent over the past three years is pretty nice.

Of course, the full data set includes the major down periods like the Great Depression, the inflation/commodity shock of the 1970s and the 2008 financial crisis. To get average volatility, you need high bouts like those just mentioned and periods of relative calm, like what we’ve been enjoying.

In 2013, I found that the risk-adjusted return on the S&P 500 was in the 97th percentile of all 12-month periods. Last year wasn’t too shabby either, falling in the 75th percentile.

A lot of people are worried about the market’s high valuation. I share that concern, but I also worry that we’re all getting lulled into a false sense of security and that when average volatility returns (it is average, after all), we’ll feel more shocked than usual because we’ve grown so accustomed to low volatility.

There’s not much to do about it until that time comes though, other than mentally prepare while the sun is shining and make sure that you’re comfortable with your asset allocation.

Let me be clear, I have no predictions about the short-run, my message today is just a friendly reminder that these are the good old days and we should all be prepared for higher volatility in the future.