With a lot of focus being put on the coming end to the Federal Reserve’s quantitative easing campaign, this article will delve into some of the other factors impacting interest rates in the US. The Federal Open Market Committee (FOMC) has maintained a steady course ever since Chairman Bernanke first hinted at the end of quantitative easing in the spring of 2013. The “Taper” which is scheduled to complete this October sent ripples across the market – an event we all know as the “Taper Tantrum” – but since then, the FOMC has more or less flown under the radar.

The impending crash in the bond market hasn’t come – in fact, bond performance has been quite strong this year with both term risk and credit risk paying off for investors. Interest rates are still very low, but in the context of interest rates around the world our rates appear attractive.

Many fixed income investors, either through onerous capital requirements or outright restrictions, cannot invest in bonds denominated in foreign currencies, but if we use this year as an example it’s easy to see that factors impacting bond markets outside the United States can have implications domestically.

In a way, developed economies around the world are all facing the same struggles. Central banks are responding to weak economic growth and low inflation with asset purchasing programs aimed at lowering interest rates.

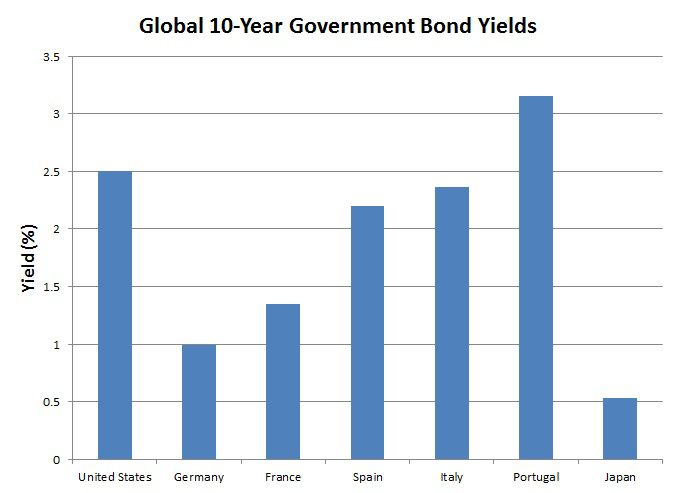

In Europe, deficit spending led to unmanageable amount of debt in countries like Greece, Portugal, Spain and Italy. Things came to a head in 2012 and the panic was eventually extinguished with a de facto bailout from Germany, in exchange for structural reforms. While US Treasury bonds were downgraded from AAA by S&P, the credit problem in the Eurozone was much different. This made it that much more difficult for the ECB to lower interest rates, but as you can tell from the graph they have managed to do it.

Japan is a bit different still. While the market isn’t pricing any credit risk into the yields on Japanese government bonds, debt to GDP is over 200% and trending higher with a growing debt level and negligent GDP growth over the last 20 years. The Japanese Central Bank is knee deep in a battle with deflation – driving interest rates lower than any country in the world. The Japanese yield curve is a bit of an anomaly, but I thought I would throw it up there anyway.

The majority of focus on interest rates in the United States is centered on domestic factors. US economic growth, monetary policy, inflation and demand for other asset classes like stocks, real estate and commodities have historically had the largest influence on price movements in the fixed income market, but in this era of extremely low interest rates, the global interest rate landscape is clearly impacting bond prices in the US.

Then why aren’t interest rates higher?

It’s a question we get a lot. Economic growth is improving – US GDP grew at an annualized rate of 4.2% in the second quarter, personal consumption grew at an annualized rate of 2.5% and inflation is slowly tending upwards – year on year headline inflation measured 2.0% in August. While the Fed is expected to maintain a target rate for Fed Funds below .25% at least through the first few months of 2015, they will be finished adding to their portfolio of longer-term bonds by this October.

While all of these factors have pushed longer-term rates higher, the movement in rates has fallen short of what many thought would materialize. I think low interest rates in other markets carry most of the blame.

I don’t want to get too deep into why interest rates in countries like Spain, Italy and Portugal are so low. Yields in those markets have fallen from panic levels, (Portuguese 10-year yields topped out at over 17% in 2012), but few in the market believe that the austerity measures forced on these countries in exchange for bailouts will do much of anything to solve the structural issues that caused the problem in the first place.

The bailouts are pushing yields below their natural levels, driving global investors seeking the proper balance of risk and return into US government bonds. Higher quality European government bonds (Germany and France) are also being pushed lower. The spread between US Treasury bonds and German Bunds has not been this wide since the late 90’s – the yield curve in Germany is actually negative all the way out past 3-years.

Interest rates in the United States are still more influenced by domestic economic data than any other factor. If growth and inflation continue to trend higher, interest rates are likely to rise despite of the influence from the global market – but it’s still far from a sure bet. Trying to explain why things are the way they are is hard enough – trying to forecast the future is impossible.