Every now and then, I come across some research that really drives a point home.

Yesterday, I found a terrific study by JP Morgan on what they called catastrophic losses – or what kids today might call ‘epic fails,’ which Urban Dictionary defines as: a complete and total failure when success should have been reasonably easy to attain.

In the JP Morgan study, a catastrophic loss is defined as a stock that falls 70 percent from its peak value. So, for example, one of the tech bubble poster boys, JDS Uniphase, once traded for ~$1,172 per share and closed yesterday at ~$12 per share (adjusted for splits).

You don’t have to go back to the tech bubble, though, consider this list of stocks from a variety of industries: JC Penny, Citigroup, Boston Scientific, Thornburg Mortgage, Silicon Graphics, Smurfit-Stone, Sprint, Revlon, Chesapeake Energy, American Airlines, Lehman Brothers, Pacific Gas & Electric – not to mention the actual frauds like Enron and MCI Worldcom.

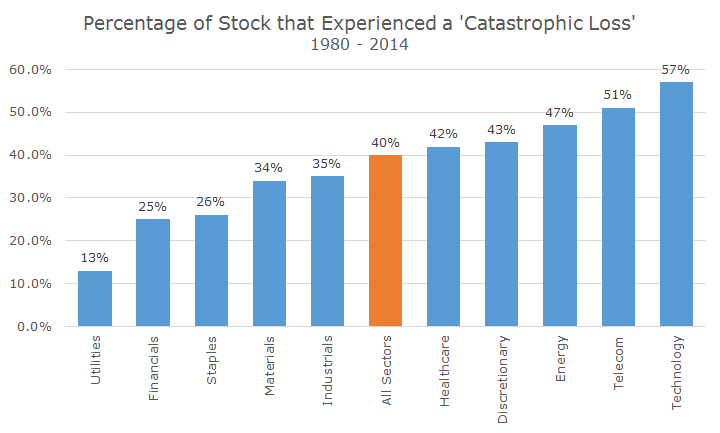

I tried to pick well-known brand names to make a point, but the amazing thing about the JP Morgan study is the frequency of catastrophic losses:

Across all industries, the percentage of stocks in the Russell 3000 that lost more than 70 percent from peak-to-trough at one point was a remarkable 40 percent. That’s not a whole lot better than a coin toss!

Perhaps not surprisingly, the technology sector has the worst catastrophic loss rate at 57 percent (worse than a coin toss!). That makes sense, partly because of the tech bubble/burst, but also because new technology constantly comes along and destroys the current standard. The gales of creative disruption are fast and powerful in the technology industry, where they say that two guys in a garage can create a faster, better algorithm.

Also not surprisingly, the utilities industry has the smallest percentage of catastrophic losses at 13 percent. These are highly regulated companies with government mandated profit margins to make sure that people (translation: voters) don’t go without basic services like water, electricity, etc.

Given the recent financial crisis, I would have expected to see a greater percentage of catastrophic losses in the financial services sector, even with the government bailouts. Citigroup, for example, was bailed out three times, but shareholders still lost 97 percent between November 2006 and February of 2009.

If the study authors had asked me, I would have preferred that the percentage loss deemed to be catastrophic be more than 70 percent. Since 1980, when the study begins, there have been two terrible bear markets that saw peak-to-trough losses of 50 and 55 percent respectively. It isn’t too much of a stretch to get from 55 percent to 70 percent.

Still, the implication is obvious – if you have a concentrated position, the odds are relatively high that you’ll experience a catastrophic loss. We meet people who have concentrated positions all the time and they usually don’t want to sell because there will be meaningful capital gains consequences.

That’s an important factor, of course, because a loss of nearly 30 percent to taxes (assuming a zero cost basis, the top Federal bracket and the Missouri state rate), is very substantial – though not catastrophic.

I think you have to ask yourself whether you would rather have the certainty of 30 percent less or a 40 percent chance of having 70 percent less.

In math terms, the two are not that different actually. A statistician (or gambler) would multiply the 40 percent chance of loss against the 70 percent loss and get an average loss rate of 28 percent. That’s lower than the 30 percent tax loss, so it’s close.

Of course there are other factors to consider, including the sector. Someone holding a utility would do that same math and find that average loss is nine percent and may hold (lower is better). A technology stock owner will do the math and see an average loss of 40 percent, which is greater than the tax rate and sell.

The odds are only part of the equation – investors care about frequency and magnitude. What if the odds are better for a consumer staples stock, you hold on and suffer a catastrophic loss. What if that loss means that you have to change your lifestyle? That’s a pretty bad bet because while the frequency was in your favor, the magnitude became a problem.

Over the years, we’ve seen this a number of times (against our advice) and the results can be devastating, which reminds me of another factor: human emotion. How do you think you’d feel if your concentrated position blew up and you had to change your lifestyle?

This study highlights the risk of concentration, something we have always been concerned about. My wife inherited some stock that her grandfather had bought in the 1940s. Since he gave it to her while she was alive, the cost basis was $0.05 and the stock was trading at $55.

It was 10 percent of our net worth and I sold 90 percent of it over five years and exited around $30-35 per share, pre-tax. The taxes were a stinker and I didn’t sell at the top, but a few years later, the stock traded as low as $8.5 during the crisis and is at $26 today.

I had no idea what the odds were, but it wouldn’t have mattered because when it happens to you, it stops being academic and starts being real.