Even though the US banking system is still under strain, I said last week that the current circumstances were not like what happened in 2008, and I stand by that view today.

The 2008 financial crisis started because banks, in the aggregate, made bad loans that couldn’t be paid back. We all remember the easy lending standards that went beyond subprime loans. Who can forget the NINJA loan? No Income, No Job or Assets.

The situation at SVIB is partly about how interest rates rose and hurt their bond portfolio, but also about a bunch of Silicon Valley venture capitalists that all pulled their money out at the same time causing an old-fashioned bank run.

Although I’m less familiar with the circumstances, the failure at Signature Bank was less to do with crypto and more to do with the FDIC’s lack of confidence in Signature’s management.

With the contagion now spread overseas to Credit Suisse, it’s natural to ask again whether it’s like the 2008 global financial crisis.

I’ll lay out some of the Credit Suisse’s details in a minute, but I still maintain that the current bank problem isn’t like 2008 with widespread bad loans.

That said, the current issue is probably more than three or four ‘one-off’s’ and we haven’t seen the end of it. Although I don’t know who it may hit next, I suspect others will fall as the weak hands can’t deal with higher interest rates.

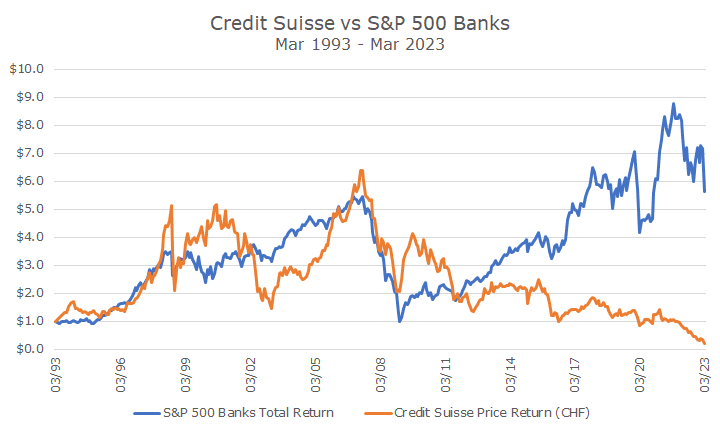

Credit Suisse was surely a weak hand. The chart below shows the performance of their stock for the past 30 years compared to the S&P 500 Bank index.

The chart is imperfect for a few reasons. First, it only shows the price return for Credit Suisse and excludes dividends, while the S&P 500 Bank index includes dividends. Second, the Credit Suisse return is in Swiss francs, so it doesn’t include currency swings that a US investor would experience. Lastly, I’ve pretended like the performance so far in March represents all of March, which hasn’t played out yet.

Even if all of these apples-and-oranges differences were fixed, the chart would tell you the same thing: Credit Suisse never recovered from the 2008 financial crisis.

Credit Suisse didn’t take government funds in 2008, suggesting that it was in a pretty good position at the time. But since then, the company has faced problem after problem, from systemic money laundering charges to over-lending to good customers that cost them billions in trading losses (Archegos).

Over the weekend, Credit Suisse, Switzerland’s second-largest bank, sold themselves to Switzerland’s largest bank, UBS, for 3 billion Swiss francs. That’s a mighty fall from the 105 billion Swiss franc market capitalization in 2007 – or even the 7 billion Swiss franc market cap last week.

It will be interesting to see how the markets digest the merger and treat UBS stock. That goes for some of the US bank stocks that suffered last week too.

As always, we’ll be monitoring the situation, but unlike last week when I sent three Acropolis Insights emails, my current plan is to go back to the regular weekly schedule.