When I was a senior in college, and just starting to take some finance classes, my professor expressed deep concerns about the stock market’s valuation at the time.

Of course, at the time I had no idea what he was even talking about, let alone an opinion about whether he was right or not. Using my trusty Bloomberg terminal, I can see that the price-earnings (PE) ratio for the S&P 500 was about average – not expensive or cheap.

In retrospect, I can see that it was a great time to buy stocks because there were five glorious years of 20+ percent returns that created one of the greatest bubbles of our time (the bubbles are great, not the aftermath).

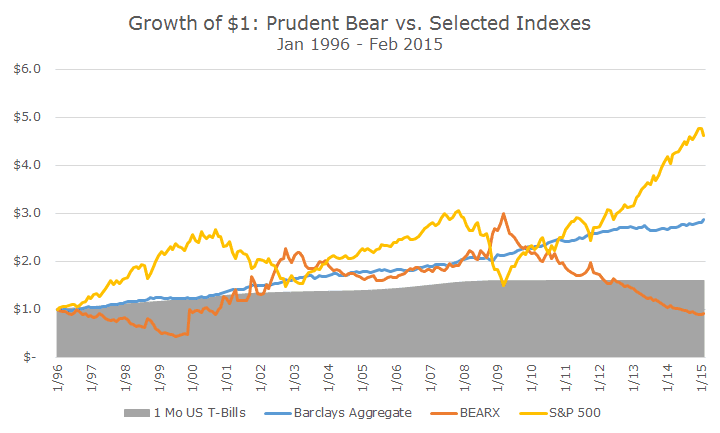

It was around that time that the Prudent Bear Fund (ticker: BEARX) was formed and managed by David Tice, who was a regular on CNBC predicting doom for stocks. To be quite candid, he was right – stocks were grossly overvalued in the late 1990s and there was hell to pay in the early 2000s.

When the tech bubble burst, Tice’s BEARX performed fabulously, earning a 143.3 percent while the S&P 500 fell -42.5 percent. It was a massive win and I’d be willing to bet that he felt vindicated for all of the times that he was openly criticized for his bearish outlook.

When the stock market did turn around and started to recover, Tice’s fund started to run into trouble again. I really don’t remember this, but I suspect that he was doubtful of the recovery and felt that any positive results were false dawn and he would be vindicated again.

To some extent, he was right because it was only six years after the tech bubble that the S&P 500 headed into the worst downturn outside of the Great Depression. Just as before, Tice’s BEARX performed very well, earning 45.8 percent while the market dropped -46.7 percent (I’m using monthly data, which is less dramatic than peak-to-trough numbers, but a lot easier to find).

So, why not include some bear market protection to a portfolio in case we find ourselves in the midst of another crash?

Believe it or not, you can actually make a case for holding BEARX (or something like it) even though it is a highly volatile money loser. What makes it work is that BEARX is dramatically uncorrelated with stocks.

A roughly 60/40 mix of the S&P 500 and BEARX would have returned 7.25 percent with an annualized volatility of 5.24 percent, for a Sharpe Ratio of 0.91 from 1995 to today. If I wanted a portfolio with identical volatility made up of just stocks and bonds, the best combination would have only earned 6.52 percent, for a Sharpe Ratio of 0.77.

Of course, I am calculating these hypothetical portfolios with the benefit of perfect hindsight: the race has run and I am just scrutinizing the results to see what I can find. Just because it ‘worked’ during this period doesn’t mean that we would actually want to pursue this strategy going forward.

After all, BEARX did benefit from two of the five worst US stock market routs of all time while they were operating. While we could potentially be in for a ‘new era’ of where stocks crash more frequently than they have in the past, that’s an expensive bet because having BEARX is brutal during bull markets.

One of the key ingredients in our strategy is finding asset classes or strategies with positive long-term expected returns. A fund or strategy that is permanently negative on stocks shouldn’t fare well, and, in fact, it didn’t.

I have to admit that I underestimated the impact of such deeply negative correlation. When we diversify into bonds, which also have a positive expected return even in today’s yield environment, we get no correlation, which is actually different than negative correlation.

I suppose that as long as the loss on the bear market strategy is smaller than the gain on stock portfolio and the correlation is negative enough, it works.

Still, the results are not different enough from the conventional 60/40 stock/bond portfolio to make me want to pursue a strategy that I believe will continue to be volatile and lose money over time, in the hopes of achieving lower portfolio volatility.