One of the complaints that I hear about index funds is that their returns are average and buying them guarantees mediocre returns. Not so!

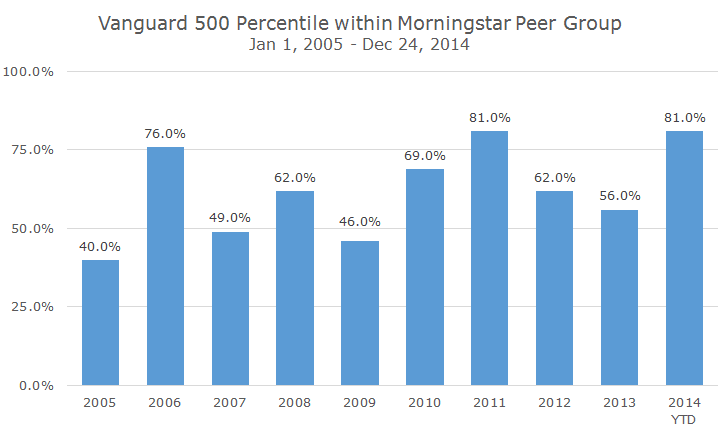

If that were true, you would expect that the returns for the Vanguard S&P 500 index fund (VFINX) would be around the 50th percentile when measured against its peer group.

The actual percentile might shift around some from year-to-year, in the 40th percentile one year and the 60th percentile the next, but you would expect it to essentially hang around the middle of the pack.

The data from Morningstar tells a different story. Assuming that not much will change in the last three days of the year, it appears that the VFINX will be approximately 80 percent of its large cap blend peers, as calculated by Morningstar.

The following chart shows the percentile ranking for this fund for each year of the last decade (counting 2014 as a complete year – this isn’t data mining either, 2004 was a good year with VFINX outperforming 64 percent of its peers).

There are three years where the fund fell in the bottom 50th percentile of funds and a few years where it beat by roughly the same amount. But there were three years – 2006, 2011, and 2014 – where a simple index fund beat more than three-quarters of its close competitors. And in no year did it under perform by this kind of margin.

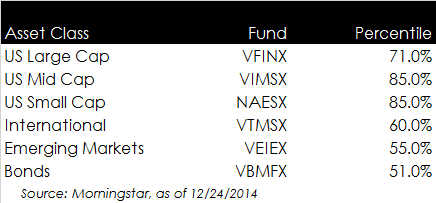

The results are even more impressive if you look beyond the year-by-year results individually, and instead look at the totality of the 10-year period. Morningstar reports that for the 10-years ending on December 24th, VFINX was in 71st percentile compared to its peers.

For that 10-year period, VFINX outperformed the category by 0.53 percent per year, which compounds to a 5.43 percent cumulative outperformance over the decade.

It’s not just large cap either – here is the percentile rank of a simple Vanguard index fund compared to its peers for the 10-years ending December 24th for the major asset classes that we invest in:

I will caveat this data by saying that it’s important to understand how the peer group is constructed. For large cap stocks, it’s pretty straight forward.

It can get a little more complicated for other asset classes. How do you categorize a fund that is 10 percent US stocks, 10 percent emerging markets and 80 percent developed markets? Of course, you put it in the developed markets category, but the returns will look different because the fund has large allocations to areas that the index fund won’t.

Even still, the argument that index fund guarantee mediocrity seems difficult to make based on the last decade worth of data. It’s possible that the next decade will be different, but I doubt it.