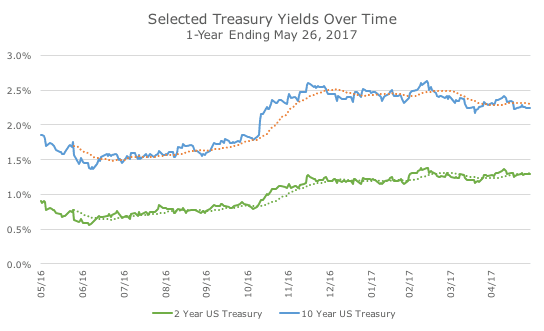

Almost a year ago, the yield on the 10-year US Treasury hit an all-time low, falling to 1.36 percent, just below the previous all-time low of 1.39 percent, set in 2012.

After the yield on the 10-year bottomed last summer, the yield drifted slowly higher until the election when, boom, it shot dramatically higher overnight. Investors were optimistic that the Trump administration might bring faster economic growth through a combination of tax cuts, deregulation and fiscal policy.

For years, I’ve heard that yields are finally heading higher and, as you might imagine, I heard yet again, ‘okay, now they’re really heading higher’. Of course, I don’t know where yields are going, but I’ve come to doubt that they’re headed much higher anytime soon.

It’s a little hard to see in the chart above, but if you look closely, especially at the moving average in orange, you can see the yield drifting lower again recently. But that image doesn’t tell the real story in my opinion.

In addition to the yield on the 10-year, I’ve plotted the yield on the two-year Treasury over the same time period, in green. The difference between the two- and 10-year bonds, referred to as the ‘spread,’ is the real story in my opinion.

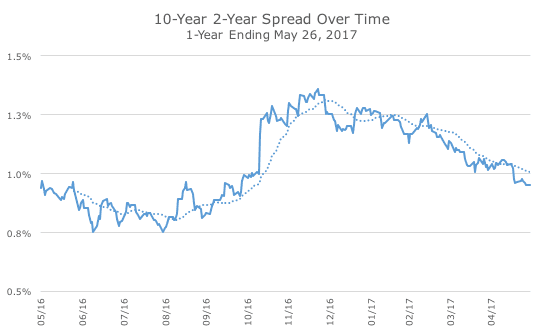

The chart below shows the spread, which is now back to the same level as the election. Viewed this way, a higher spread signals a steeper yield curve while a falling spread represents a flattening curve. What we see is a sharp steepening after the election and a slow flattening since then.

Said another way, the yield on the 10-year is falling faster than the yield on the two-year, which is anchored by what the market thinks the Fed will do with the overnight funds rate.

What does a flattening yield curve tell us? In general, a flattening curve signals weaker economic growth and/or falling inflation expectations – the opposite of what investors expected immediately following the election when the yield curve steepened.

While the stock market is still signaling optimism, the bond market seems to be heading back to the slow growth and low inflation expectations the it had prior to the election. Obviously, it’s too soon to see whether stock or bond market investors have it right, but it’s important to keep your eye who’s saying what now.