At the end of October, I wrote that investors could earn a tax-free nine percent yield on their fixed income portfolio buy purchasing bonds issued by Puerto Rico.

In the article, I said that ‘markets caught on before the bond ratings agencies’ since prices had fallen dramatically while Moody’s had just cut their rating from Aa3 to A2, which is still five rungs above investment grade.

A little more than three months later, S&P cut Puerto Rico’s bonds to junk status. The other two major ratings agencies, Moody’s and Fitch are apparently considering similar cuts.

Bonds issued by Puerto Rico barely changed on the downgrade news.

The point of my October article was mostly that a nine percent yield is a signal of high risk and that if a yield seems to good to be true, it probably is.

Another equally important lesson is that credit markets (like stock markets) are very efficient about pricing in new information, much more so than rating agencies or other research organizations.

Even after the bad ratings during the financial crisis, I believe that the credit analysts at the ratings agencies are qualified and exercise good judgment.

But despite their best efforts and continuous monitoring, markets priced in the default months ahead of the actual default so that when it became official, prices already reflected the news.

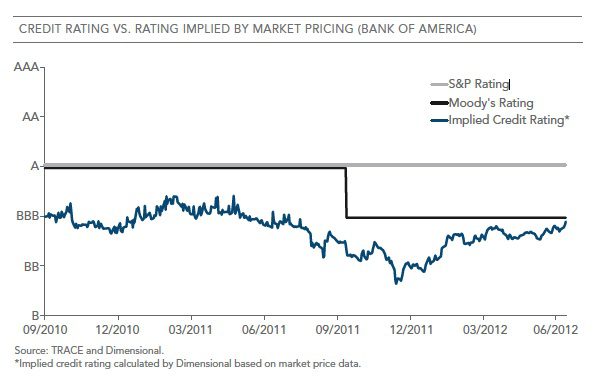

The chart below from DFA shows the implied credit rating of Bank of America bonds during the crisis along with the actual ratings from Moody’s and S&P.

The bonds funds that we use primarily for corporate/credit exposure use the market-implied credit ratings to determine what bonds to buy and own in addition to the ratings offered by the agencies.