Most of the time, the topics that I choose for Daily Insights are things that I think I know a lot about. Sometimes, I write about a topic in an effort to learn more about it.

That’s the case today: I had never heard of a border adjustment tax until a few weeks ago, wanted to know more and thought I would share what I’ve learned.

Some of you undoubtedly know more about a border adjustment tax than I do and if you think I’ve missed the mark, let me know and, if appropriate, I’ll follow up with the entire readership later this week.

As we all know, one of the key goals of the Trump administration and the Republican Congress is to lower corporate taxes. For starters, that means simply cutting the top rate from 35 percent to 15 or 20 percent.

It also means that businesses will likely be able to depreciate capital expenditures immediately, rather than writing them off over a period of many years. At the same time, however, businesses may not be allowed to deduct interest expenses when calculating their tax bills.

The last pillar of the tax reform from Congressional Republicans is a border adjustment tax. From my reading of the news, it may also be the least likely part of the plan to go through, however, since President Trump described it as ‘too complicated.’

Still, let’s see if we can get our arms around it. Today, corporations are taxed on worldwide profits, which are simply the difference between worldwide revenues and worldwide expenses.

Broadly speaking, a border tax would change the system so that corporations would only pay taxes on their US profits – the difference between their domestic revenue and their domestic expenses.

This system, known as territorial taxation, means that taxes would only be assessed on the value added of goods consumed in the US. Of course, not all of the goods that are produced in the US are consumed here and some of the things there are produced here are consumed elsewhere.

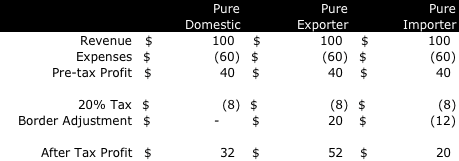

The border adjustment tax attempts to resolve this issue by taxing imports and rebating taxes on exports. An example may be helpful, so take a look at the table below to see how a border adjustment tax would impact three companies: a purely domestic company, a pure importer and a pure exporter.

Let’s start with the purely domestic company that doesn’t face a border tax. It’s quite simply, if revenues are a $100 and expenses are $60, the pretax profits are $40. Those profits are taxed at 20 percent, or $8, leaving $32 in after-tax profits.

Now, let’s look at the pure exporter that incurs all of their expenses in the US, but earns all of their revenues overseas. In this case, the revenues, expenses and pretax profits are the same. However, the pure exporter gets a credit equal to 20 percent of revenues, or $20, which boosts the after-tax profits to $52.

The third company is a pure importer, meaning that the all of their expenses are overseas and all of their revenues are domestic. This company, however, owes an additional tax of $12 on top of the regular $8, so that their total taxes are $20 and the pretax profits are now $20 – well below both the domestic company and the pure exporter.

Clearly, this structure, as described above, is good for domestic producers, great for exporters and not too hot for importers. However, the example above assumes that the market doesn’t response to the changes, which of course, it would.

Almost certainly, the dollar would appreciate because imports would fall and exports would rise. In theory, the dollar would rise to the point where all three companies have the same after-tax profits. This is where it gets complicated: the costs for the importer would fall, increasing pretax profits, which offset the higher taxes.

At the same time, revenue for the exporter would fall, which would lower their tax credit and reduce their after tax profit. In theory, the after tax profits equalize after the currency adjustment.

So if the after-tax profits are all the same, what’s the point? First, as long as the US imports more than it exports, it will raise revenues. Second, this process cuts some of the games that companies play to avoid US taxes on their worldwide income.

I’m afraid that I don’t have much of a conclusion for this article. I’ve read all kinds of accounts about what this might mean for companies, the dollar and even the bond market, but I don’t know enough about it at this point to draw my own conclusions (possibly a future article). My goal today was just to explain the basic concept.

Rightly or wrongly, the market seems to be discounting the likelihood of a border adjustment tax because the dollar has sold off after a pop following the election. The House Ways and Means Committee Chair Kevin Brady predicted on Friday that the border adjustment tax would be part of a tax reform package this year, but there are enough balls in the air at this point, it seems hard to say for an outsider like me.