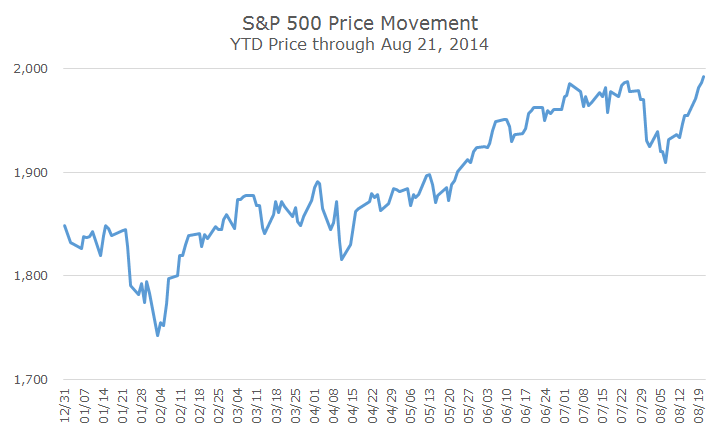

This is the bull market that just won’t quit. Just a few weeks ago, when stocks dipped it appeared we were finally getting the correction that we’ve all collectively been expecting for years now. It’s unusual to go this long without a 10 percent correction or a 20 percent drop, which is the typical definition of a bear market.

The decline that we just went through was less than four percent, which is a fair amount less than the 5.75 percent that the market dropped in January.

While researching this story, I tried to remember the point that the market fully recovered from the 2008 financial crisis, which actually started in Oct 2007. The unfortunate soul who bought stocks at the all-time high on Oct 9, 2007 in front of the bear market didn’t break even until Aug 21, 2012 – what a coincidence that breakeven day was exactly two years ago!

In the subsequent two years, the S&P 500 has gained 47.15 percent, which is an annualized rate of 21.31 percent, which means that the poor investor who bought stocks at the tippy-top in 2007 has still increased their net worth by 46 percent, or 5.56 percent annually.

Certainly, that’s well below the long-term average of 10 percent for stocks, but it’s better than cash, which earned nothing or bonds that earned 5.15 percent per year.

Personally, that’s all the evidence that I need to confirm the theory that stock investing pays off over the long run. Here we went through the worst market drawdown outside of the Great Depression and investors who bought on the worst possible day of all time got all of their money back and earned a respectable return.

If we extend our time horizon to, say, 12-years (which just happens to coincide with our 12-year anniversary), the annual return for the S&P 500 is 8.62 percent. To some extent that’s fortunate timing because we only caught the third year of the three year tech wreck, but, still, that’s a good result and consistent with the long-term average return.

I’m not saying that the ride was easy. Sadly, I can’t blame all of my gray hair and extra pounds on the market volatility and related stress over the past dozen years, but it was definitely a factor.

Over the next 12 years, I suspect I will get more gray hair and hope to lose those added pounds (thanks to a not-yet-invented diet pill). I also think that stocks will continue to gain, although probably less than the historic average given today’s market valuation. It will be volatile, as it always has been, but I believe that patient and disciplined investors will reap rewards in the future as they have in the past.

I have nothing to say about the next 12-weeks or 12-months except to expect volatility, but that’s easy, like saying that it will hot in the summer and cold in the winter, it’s just part of the experience.