In September 2011, Switzerland’s central bank, the Swiss National Bank (SNB) decided that it didn’t want the Swiss franc to become too valuable against the Eurozone common currency, the euro.

For better or for worse, the Swiss franc has been considered a safe haven and during the sovereign debt crisis a few years ago, money poured into the franc.

That was a concern for the SNB since it could have pushed them into a recession or led to deflation, so they decided to peg the franc to the euro. Under this regime, the franc would trade for 1.2 francs per euro.

Since 2011, the peg was relatively stable and the SNB repeatedly said that they would maintain the peg with ‘utmost determination.’

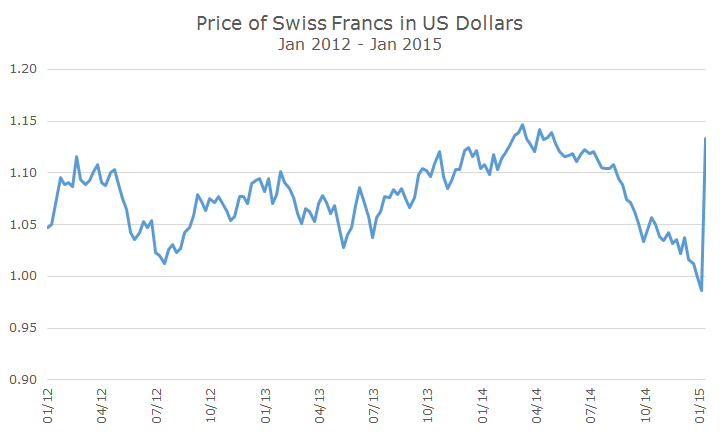

Then, without warning, they decided to let the franc trade freely and – snap – the value of the franc shot up 30-40 percent in just a few moments. By the end of the day, the franc gained 17 percent versus the dollar, a huge move for any country, but a remarkable shift for a developed country.

In the same meeting, the SNB decided to lower interest rates from -0.25 percent to -0.75 percent, which should have offset some of the shock from dropping the peg, although it’s hard to say whether it had any impact at all.

The Swiss stock market fell nearly 15 percent from the open, although it recovered some and closed the day down 9.5 percent. Interestingly, US investors don’t feel any of that pain because the increased value of the franc more than offset the declining value of the stocks.

The timing is interesting because it’s just one week in advance of the European Central Bank (ECB) meeting where it is widely expected that the ECB will initiate a bond buying program like the one that the Federal Reserve just finished.

If the ECB does act, most investors expect that the euro would decline compared to other world currencies. That would make it much more expensive for the SNB to keep the peg in place, so it’s fair to assume that the SNB thinks that a program will be announced.

In some ways, this is a historic event. Statistically speaking, this shouldn’t happen – based on the last three years of volatility, this one day is a 30 standard deviation event, which means that the odds of you winning the lottery were better than predicting this outcome.

At the same time, this is a nonevent for us. If we were swashbuckling hedge fund traders who leveraged up to go short the Swiss franc and long the Swedish krone (as Goldman Sachs recommended as a ‘Best Idea’ in 2015), we would be unhappy campers. Without leverage, that trade has lost 16 percent this year, but it would be rare to enter into a market neutral trade like this without leverage.

For us, the impact is primarily philosophical. The first lesson is to be wary of central bank statements. The entire market, which includes us, hangs on the words of every Fed comment. The SNB said one thing for three years, and then completely shifted gears without warning. I hope the Fed doesn’t do that.

Second, it’s an early reminder that markets are unpredictable. I say early because we had several big surprises last year, most notably lower interest rates and falling oil prices, but they weren’t obvious until the end of the year.

We’re just half way through the first half of the first month and we get a shocker. Thankfully, this reminder didn’t cost us anything.