A year ago, the consensus was that the US economy would likely enter a recession within a year. The yield curve was inverted, the index of leading economic indicators was in the tank, and it wasn’t clear when the Fed would start cutting rates.

I often look at Bloomberg’s survey of economists, which asks the probability of a recession in the next year. It’s an imperfect measure, but economists should have a good sense of what’s going on and what might happen in the near future (or as good a sense as anyone else).

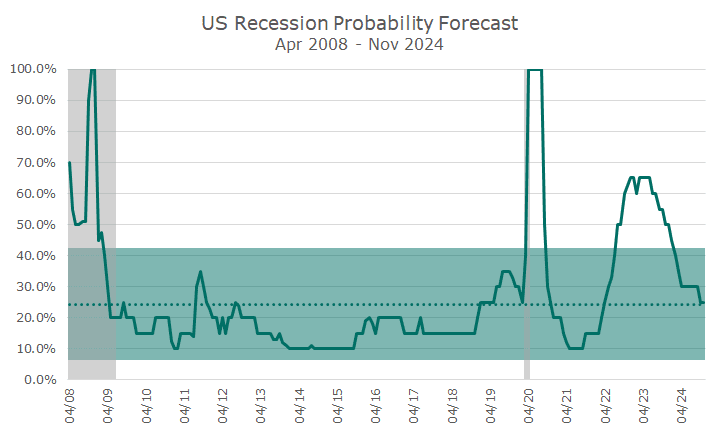

The chart above tells the story with a few bells and whistles. First, it shows the economists’ average reading over time, as shown by the solid green line. The most recent reading is 25 percent for the second month.

Since Bloomberg started tracking this data, I’ve highlighted the recessions, represented by the gray bars. The pandemic recession is only two months long, so it’s hard to see, but it’s pretty clear in the 2008 Global financial crisis.

Then, I tracked the average reading outside of recessions. That could be cheating because we only find out when recessions occur after the fact. Take a look at the recession probability—it’s 100 percent for several months after the recession ends, according to the NBER. The green dotted line shows the average, which is 24.5 percent.

Finally, I added green shading around the average to show the ‘normalness’ of readings that aren’t exactly the average. Averages can be misleading because the data is very noisy, and people anchor on averages. Showing a range is clearer. (There is an old joke about having your feet in the oven and head in the freezer, but on average, you feel fine).

The probability of recession, as measured by economists’ forecasts, was pretty high but is back down to normal. This is a relatively new survey, and it’s hard to judge. The global financial crisis was already underway when it started, and the pandemic came on so quickly that it’s hard to say how useful the survey was.

It’s worth watching, but as you’d expect, it’s no silver bullet.