We’ve all heard that the S&P 500 is more concentrated than it has been in decades. Indeed, the top 10 holdings in the S&P 500 now account for a whopping 33.8 percent of the index. That’s right, ten of the 500 stocks in the index equal more than one-third of the value of the index.

I’m a fan of global diversification, but it’s been a frustrating decade, given how well the S&P 500 has done compared to developed or emerging markets stocks.

Still, I’m a true believer partly because of the diversification and partly because valuations are much more attractive overseas. Another argument that I believe is that foreign stock markets are far less concentrated than the S&P 500.

The chart below shows the weight of the ten largest stocks in our five equity asset classes. The S&P 400 mid-cap index, the S&P 500 small-cap index, and the FTSE developed market index are highly diversified, with no more than one percent of the holdings in any given stock.

None of those three indexes have more than a total of eight percent of the index in the ten largest stocks.

The exception is the emerging markets index, where the largest holding is not very different than the S&P 500’s largest holding at seven percent. The largest holding drops off from there and the top ten largest holdings are 20.5 percent of the index.

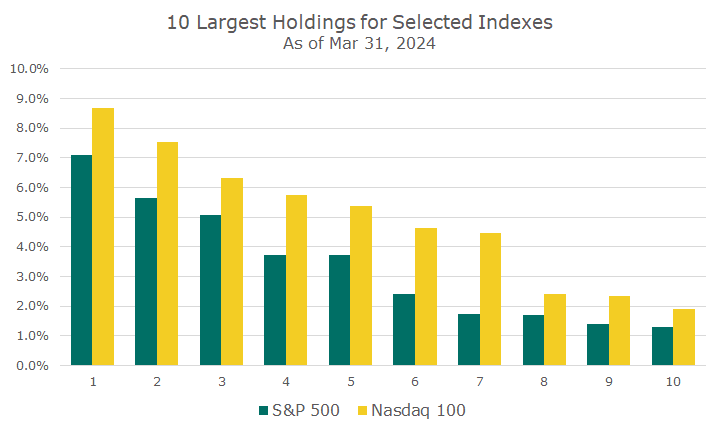

Even though I’m bothered by the concentration in the S&P 500, I started to wonder about the ‘hot’ indexes that everyone is talking about, specifically, the Nasdaq 100.

The top ten largest holdings in the Nasdaq 100 amount to a whopping 49.4 percent of the index. I knew it would be high, but was very surprised that ten stocks account for half of the value of the index.

After looking at the tech-heavy Nasdaq, I wondered about the growth and value indexes. I put the S&P 500 index for reference, even though I already showed it in the first two charts.

The orange bars represent the growth index, and the top ten holdings in the S&P 500 Growth index made the Nasdaq look conservative! A full 58.6 percent of the S&P 500 growth index, which has 231 stocks, is in the top ten holdings.

Naturally, I looked up the S&P 500 Value index and was relieved to see what I expected: a lot less concentration—about 18.9 percent of the value index is in the top ten holdings, which isn’t immaterial, but nothing like the growth or broad market.

We often measure risk by the volatility of returns, which is sensible, but looking at the concentration is a good reminder of other risks that investors face.

It’s also a relief to see that there is a good, old-fashioned solution to the concentration issue, which includes diversification to developed and emerging markets, smaller US stocks, and a value tilt in US markets.

These asset classes haven’t performed as well as the S&P 500 (or Nasdaq or Growth indexes), and while those risks have paid off for some time, they won’t always.