In the first quarter issue of Portfolio Insights in 2017, I wrote that Acropolis was phasing out our exposure to inflation-protected bonds, also known as TIPs (for Treasury Inflation-Protected Securities).

At the time, inflation was low and stable, and although I whole heartedly supported removing TIPs, I wondered what would happen when we were hit with surprise inflation, which is when TIPs work best.

Well, it took five years for the surprise inflation to show up, but now that we’ve been living with higher inflation for the past two years, I thought I would check in on how inflation protected bonds fared.

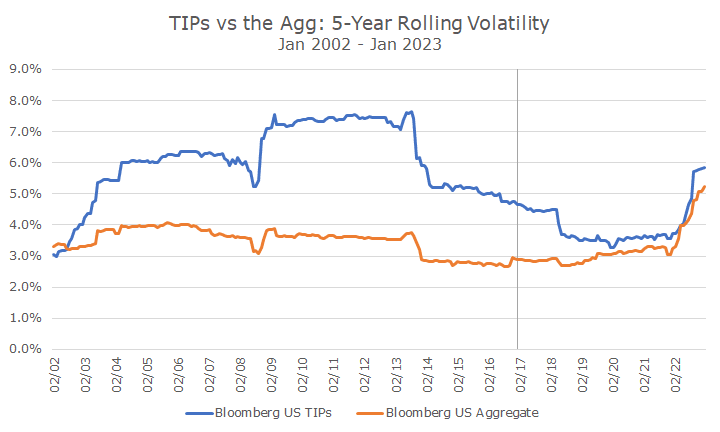

Our rationale for exiting TIPs was that they were too volatile compared to the overall bond market and they didn’t provide any excess returns. We take the view that risk and return go hand-in-hand, so why take the risk without getting a reward?

Let’s start with a chart that I included in the original article, updated since then – the grey line representing when I wrote the article.

You can see that TIPs were substantially more volatile than the overall bond mark at the time of my article, but shortly thereafter, the volatility levels converged.

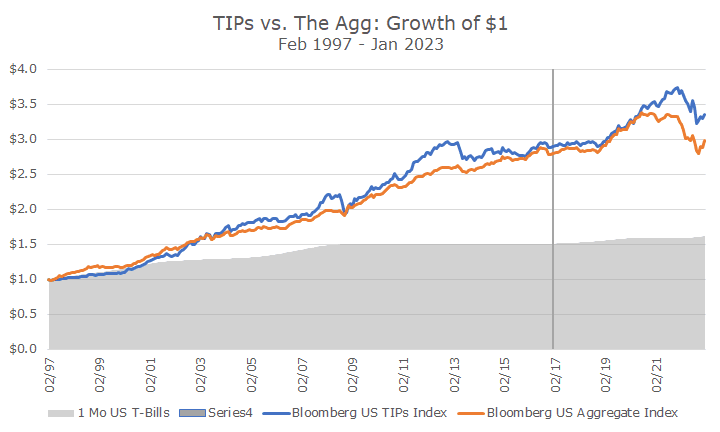

As the volatility converged, performance between TIPs and the bond market stayed remarkably steady until inflation took off in 2021. You can see that the TIPs rose in 2021 by ~5.5 percent, while the bond market fell by -1.9 percent.

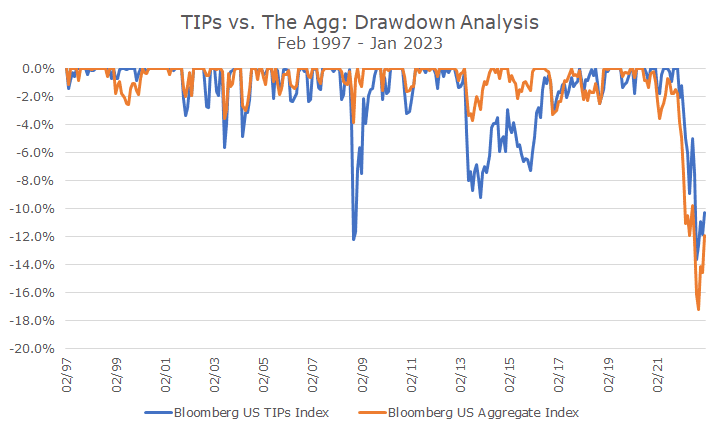

But that didn’t stop TIPs from losing money in 2022. The drawdown chart below shows that the losses were about the same. It’s also interesting to see that TIPs had two substantial drawdowns in 2008 and 2013 that the overall bond market largely avoided.

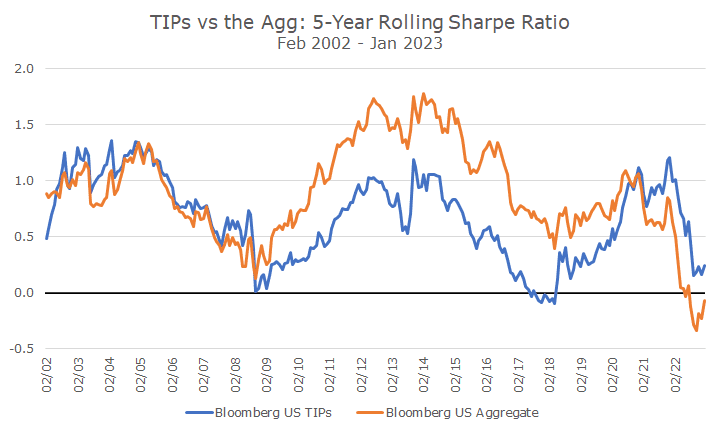

The last chart shows the rolling Sharpe ratio for TIPs and the overall bond market, on a rolling five-year basis.

And, just in case you forgot, the Sharpe ratio is the excess return over the cash, divided by volatility. It’s a way to think about the return you’re getting versus the volatility, or risk, that you are taking.

You can see in the chart that the Sharpe ratios were pretty much on top of each other until 2009, and the overall bond market lead until 2021, but now TIPs look better, but not radically so.

I ran a simple optimizer when I wrote the article in 2017, and it suggested that you didn’t need TIPs in a portfolio for the reason that we exited: too much volatility and no excess return for it, despite the somewhat low correlation.

I ran the optimizer again this weekend and found that it calls for a 12 percent allocation to TIPs, which make sense since the returns for TIPs have been good of late. Small changes to the optimizer inputs can generate meaningful changes, which is why we don’t put too much value into them anymore.

My conclusion is that TIPs are good at what they are designed to do: protect against unexpected inflation. The lousy returns in 2022 for TIPs are a good reminder that having one specific protection doesn’t protect you from other things, like rising interest rates.

That caused me to think about TIPs in a new way: if we get surprise inflation, it seems likely that the Fed will raise rates, which will cause all bonds, including TIPs to decline in value.

Just like any military reviewing what happened in the last battle, we’ll take a look at TIPs and consider again whether they make sense, but at this point, I don’t feel too bad that we didn’t have them since we exited in 2017.