At this point, the S&P 500 is still positive for the year, unlike all of the other (smaller) US asset classes or developed markets overseas, which are all down.

Emerging markets and REITs are also up this year, but emerging markets are recovering from a loss of -3.86 percent last year and REITs are benefitting from the surprise drop in interest rates.

When we think about asset class results, like large cap versus small cap, it’s easy to think of them as monolithic segments.

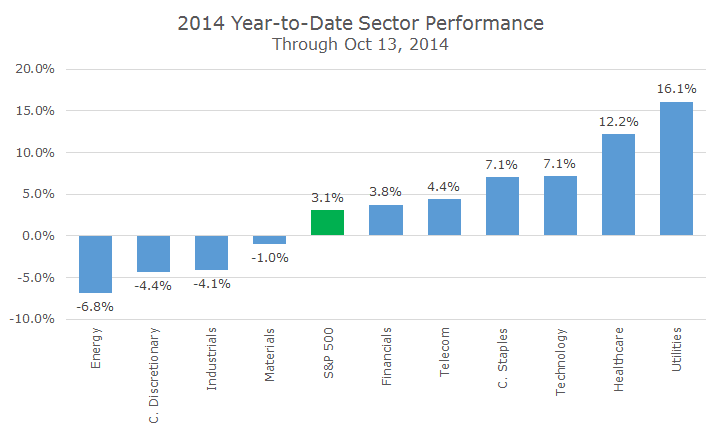

In fact, there is a lot of variation within each asset class. Consider the disparity of results within the 10 sectors of the S&P 500: energy stocks are down -6.8 percent through yesterday and utilities are up 16.1 percent, while the overall index is up only 3.1 percent.

Given stocks overall weakness this year, it’s not surprising that some of the more defensive areas are doing well: consumer staples, healthcare and utilities. By the same token, the sectors most sensitive to economic output, like consumer discretionary and industrials, are weak.

While some sectors can be neatly identified as cyclical or defensive, others are tough to nail down. For example, energy is tough to designate as one or the other because it’s sensitive to its own set of factors, namely energy prices.

This year, energy is doing the worst, but I wouldn’t say it’s because energy stocks are cyclical – well, strike that: they are cyclical, but not to the overall economy; they’re tied to energy prices that also move in cycles.

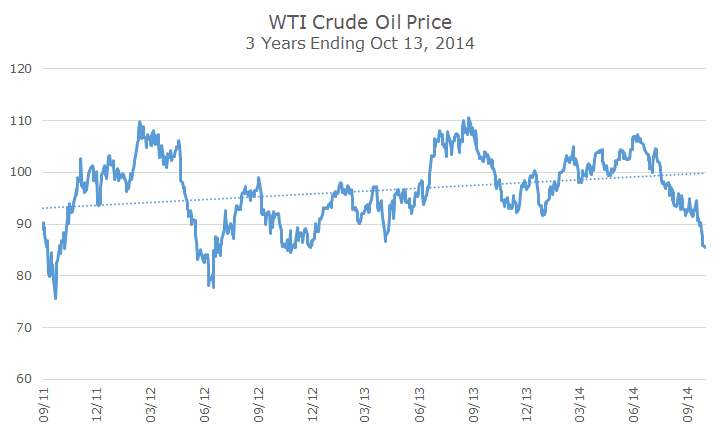

The chart below shows the price of crude oil per barrel over the past three years, and there are a number of cycles during that period. Gas prices have fallen sharply from over $107 per barrel in mid-June to $85 as of the close of business yesterday.

Oil prices are getting hit from both sides. Global growth is slowing, especially in China and the Eurozone, which is weakening demand. At the same time, there is more supply thanks to the energy renaissance in America.

In 2008, oil prices were rising sharply and hit $145 per barrel, but when the economy exploded with the bankruptcy of Lehman Brothers, oil prices plunged and fell as low as $34 per barrel. Energy companies responded by pouring money into other projects, including shale.

Since 2008, the US has cut our oil imports from OPEC countries by almost 50 percent and US crude oil production is expected to be 10 million barrels a day by the end of next year.

Lower oil prices are affecting nearly all companies throughout the supply chain from upstream producers who pull out hydrocarbons to downstream infrastructure and service companies.

Right now, markets are waiting to see what, if anything, OPEC might do. They have a meeting scheduled on Nov. 27 in Vienna, although some countries like Venezuela have called for an emergency meeting to discuss whether they should cut production to try and stabilize prices.

While it’s disappointing to see the value of our energy stocks decline, lower fuel costs do serve as a tax cut to all consumers, which could help spur the economy, and is especially nice coming into the holiday season.