The first investment strategy that I can remember hearing about is the Dogs of the Dow strategy.

One of my parent’s friends, who knew I was interested in stocks back in high school, told me one of the ‘secrets’ to beating the market.

The strategy is fairly simply: start with the 30 stocks in the Dow Jones Industrial Average (DJIA) and sort them by their dividend yield. Buy the 10 stocks with the highest dividend yield. That’s it! Rinse and repeat once per year.

Seeing the friend recently made me think of the strategy for the first time in 20 years, so I decided to look at it again armed with all of the tools that I’ve acquired over the last decade. As it turns out, there’s an exchange-traded-note (ETN) that tracks the Dogs strategy, so I was able to analyze that data easily rather than recreating the index myself.

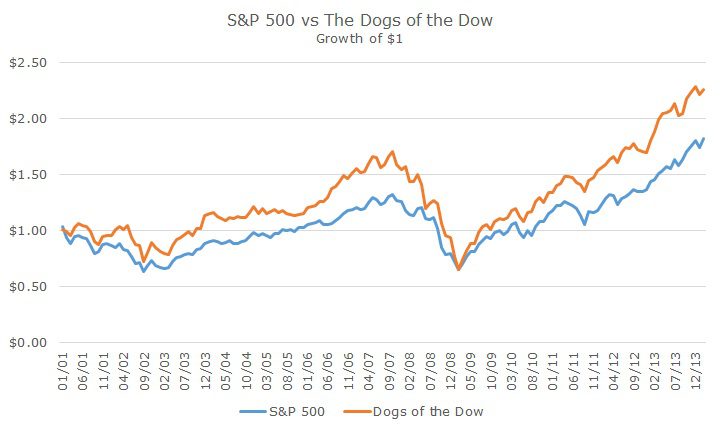

The Dogs index that accompanies the ETN dates back to January 2001 and wouldn’t you know it – the Dogs strategy worked over this time period! Through the end of last month, the Dogs strategy had an annualized return of 6.72 percent while the DJIA gained 5.82 percent.

I always complain that the DJIA isn’t a good index because it only has 30 companies and has a peculiar construction method where companies with high prices (like Visa at ~$210 per share) have a much greater weight in the index that companies with low prices (like Cisco at ~$22 per share).

These companies aren’t radically different in terms of market capitalization, but Visa is roughly eight percent of the DJIA and Cisco is less than one percent of the index.

Still, even though I don’t like the DJIA and much prefer the more diversified and sensible construction found in the S&P 500, it’s only gained 4.72 percent over the same time period.

As I put the data together, I thought about who I thought would win – the Dogs or the S&P 500 (I don’t mentally bother with the DJIA, so I was surprised that it won over the S&P 500).

It occurred to me that the Dogs is basically a value strategy – you’re buying the cheapest third of the DJIA using the dividend yield as the proxy for valuation. Imagine a company trades at $100 per share, has earnings of $5 per share (a PE-ratio of 20) and pays out a $2 dividend (a two percent dividend yield).

Something bad happens so that earning fall to $2.5 per share. The PE ratio falls to 16, which means that the stock is now trading at $40 per share. Since companies are reluctant to cut their dividends and there is still enough earnings to cover it, the dividend stays at $2 per share which means that the dividend yield is now five percent.

It’s true that the mechanism for the Dogs strategy is the dividend, but basically value investors might buy the stock because the PE ratio is now cheaper (and chances are that other measures, like price-to-book, etc. would have fallen as well).

As you would expect from a value strategy, the Dogs is more volatile than the S&P 500 – the extra return and the extra risk go hand in hand, as always. The additional volatility could also be attributed to the fact that there are only 10 stocks in the Dogs strategy, so there’s a lot more idiosyncratic risk built into the strategy.

That made me wonder how a diversified value strategy would have done compared to the Dogs. For this, I compared the Dogs to the value fund that we use.

Using our statistical software, we find that the sensitivity of the Dogs and the fund that we use is nearly identical, meaning that the Dogs strategy is deeply value oriented.

The fund that we use outperformed in a way that theory would predict: it has more exposure to small companies. Even though it is a large cap value fund, the average size company in the fund is $45 billion. That’s definitely still in large cap territory (the cutover to mid-cap is around $10 billion), but much smaller than the Dogs, which have an average market cap of $145 billion.

The size premium, that small companies tend to outperform large companies, can play itself out even within a single asset class.

Even if there was no extra performance from size, I would still prefer to own the diversified basket rather than 10 stocks just to get rid of the idiosyncratic single company risk. Since the Dogs strategy only holds 10 stocks, 100 percent of the portfolio is held in those 10 stocks. By contrast, the fund that we use has 231 companies and the top 10 holdings only represent 29.5 percent of the fund. If the diversification doesn’t cost anything in returns, why wouldn’t I prefer that?

I don’t know about you, but this was a fun exercise for me. Some of these old strategies make sense, but it’s clear to me that with modern analysis techniques, we can understand them in a much more robust way and improve upon them to accent the positive attributes (value in this case) and deemphasize the negative traits (lack of diversification).