The headlines have been filled with major macroeconomic news from China and elsewhere that have pushed stock prices lower.

It’s perfectly legitimate to factor this news into stock prices because our collective fortunes are tied together whether we like it or not. If Chinese gross domestic product falls substantially, you can be sure that ours will drop as well along with growth prospects for US companies.

Last night, earnings season unofficially kicked off with a better-than-expected report from Alcoa, the aluminum maker.

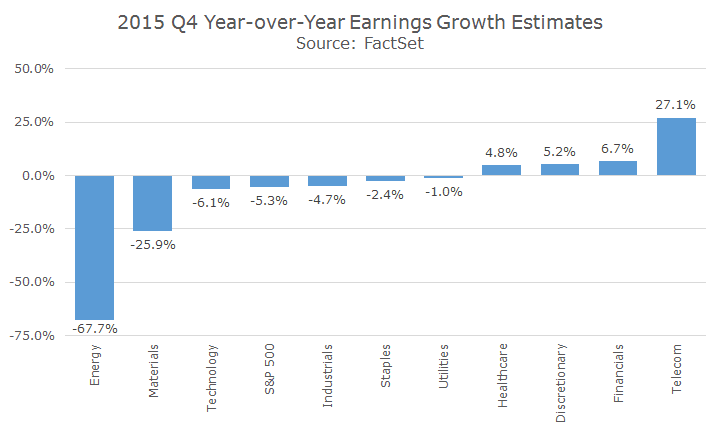

According to FactSet, earnings are estimated to decline -5.3 percent in the fourth quarter, which would mark the first time that earnings for companies in the S&P 500 have marked three consecutive quarters of year-over-year earnings decline since the 2008 financial crisis.

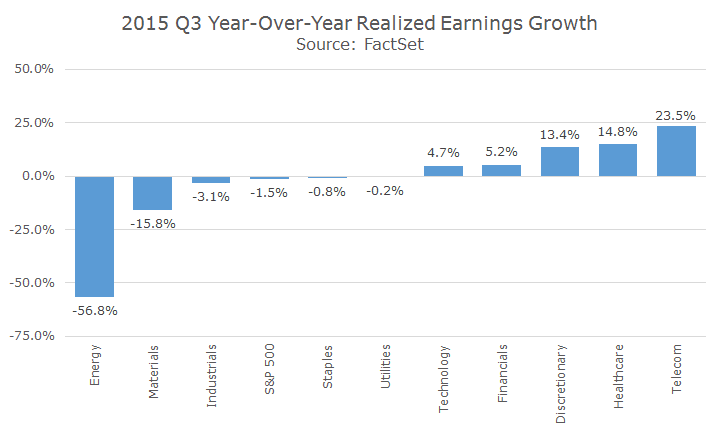

The chart below shows the year-over-year earnings for the 12-month period that ended on September 30th, 2014. The numbers may be revised slightly from here, but this is a good picture of how things turned out.

You can see that five sectors actually posted earnings growth and three of them enjoyed double digit growth. But the -56.8 percent collapse in energy profits was enough to bring earnings for the entire S&P 500 -0.8 percent lower.

The chart below shows the same idea, but instead looks at estimates for the year-over-year data for the period ending on December 30th, 2015.

Notice that the picture for energy looks even worse than it did last quarter, as it does for a number of sectors. Only four sectors are expected to post positive numbers and, of those, only telecom is expected to grow profits by double digits.

Keep in mind that these are only estimates – almost no companies have reported their fourth quarter results at this point and there will undoubtedly be a lot of surprises that will affect stock prices.

Those surprises will have a large impact on stock prices in the coming weeks, for better or for worse. The question is whether or not the macro stories like China will take second position behind earnings or simply add to the volatility.