As noted above, the Federal Reserve took center stage last week as they signaled that change is afoot with short-term interest rates.

While they did not change interest rates and did not adjust their $120 billion monthly asset plan purchases, they did indicate through their ‘dot plot’ that more members see interest rate hikes in 2022 and 2023.

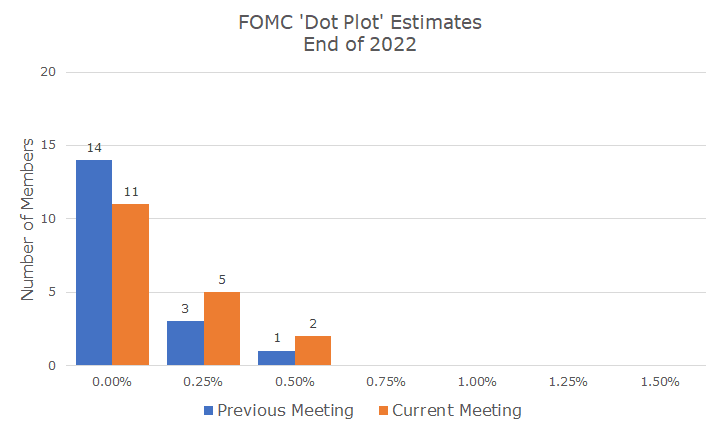

Although I don’t have a picture of the dot plot, I made a chart with the same information (the dot plot was taking too long!). The first chart shows where members (voting and nonvoting) think interest rates will be by the end of next year. That’s right – not the end of this year, the end of next year – a full 18 months away.

In the last dot plot released six months ago, 14 members thought the Federal Funds rate would be at zero, three thought it would be at 0.25 percent and one thought it might get as high as 0.50 percent.

In the meeting last week, the number of members who thought rates would stay at zero by the end of next year fell to 11, which means that five think it will be a quarter or half percent by the end of next year.

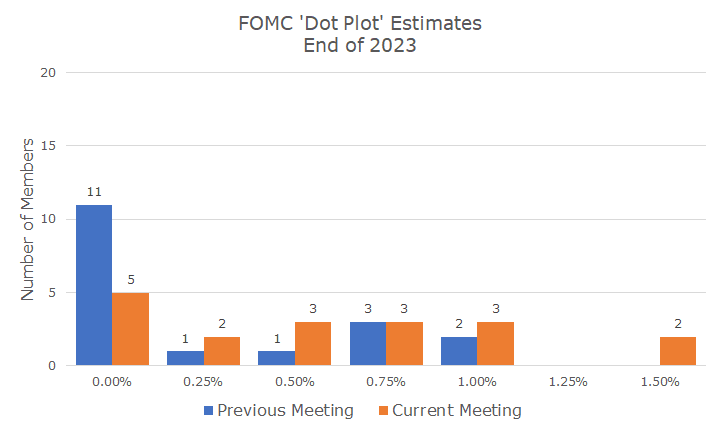

But the estimates for the end of 2022 weren’t the interesting thing to markets, it was the estimates for 2023 that got everyone’s attention.

Even at the last meeting, only 11 members thought that the Fed Funds rate would be at zero by the end of 2023, but as we can see from the chart below, that number has dropped to just five, which means that a considerable majority of members think rates will be something by the end of 2023.

There is a smattering of rates that members landed on, but the highest level by a longshot is still a fairly meager 1.50 percent. The majority of members now think that rates will be above zero but below one percent by the end of 2023.

In the news conference following the meeting, Chair Powell downplayed the significance of the changing estimates and said that borrowing costs would remain low for a long time.

Powell also said that the committee would start to discuss plans to reduce the monthly bond purchase programs, a shift from his previous statements that they ‘weren’t even thinking about thinking about’ a change.

Given the strength of the economic rebound and the worry about higher inflation, it makes sense that the Fed would shift its position. After all, nothing is changing right now, they are just letting us know that as they see the data today, they will make a change.

And, Powell indicated that if the inflation data runs hotter than they expect and isn’t transitory, they will shift again and use their tools to address the issue when the time comes.

Of course, the hard part is the timing of the changes. The end of 2023 seems awfully far off right now, and a lot of investors are worried that inflation will get out of control if the Fed doesn’t act soon enough. On the other side, if they hike rates too quickly, it could slow the economy down and hurt the recovery.

It’s a fine line and I’m glad to not have to vote.