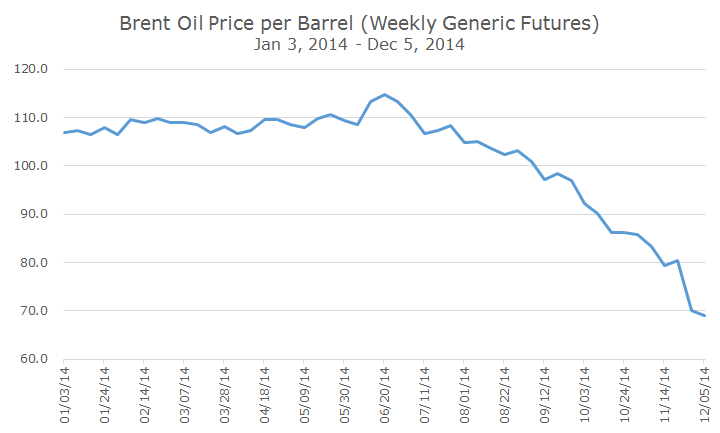

After falling interest rates, the biggest surprise of 2014 is the dramatic selloff in oil prices.

One of the great things about having a Bloomberg Terminal, is that you can go back in time and look at forecasts as of some date in the past. So, I entered my time traveling machine to see what the professional forecasters had to say about what oil prices might do in 2014. Spoiler alert: they got it wrong.

In December of last year, the average price for Brent crude was $110 per barrel. The average forecast called for oil to fall modestly to $102 per barrel, a seven percent drop. There were a few oil bulls calling for oil to rise to $115 per barrel and a handful of oil bears that thought the price of Brent would drop to $90.

The market based mechanism that looks at current prices on futures contracts to estimate what the market thinks will happen in the future suggested 2014 would end with oil around $109 per barrel. So, you could say that, based on market pricing, the market thought oil would rise and that, on average, the forecasters were right that prices would fall.

Getting the direction was about it, though, since the magnitude was way, way off. Right now, Brent is trading at $66 per barrel.

What you can see from looking at the chart above is that the selloff in oil prices didn’t really begin in earnest until the end of summer. So, I decided to step into my time machine and look at what the forecasters were saying right before the selloff.

And, they really hadn’t changed anything. In June, the average forecast called for the prices to rise to $106 per barrel, with a high estimate of $128 and a low estimate of $85 per barrel. The market price based mechanism still suggested the year would close out at $110 per barrel.

Now, I can’t chide these guys and gals too much for getting it wrong – I’m not better at forecasting and had absolutely no idea where oil would trade this year. I didn’t have a forecast at all, and had to say, ‘I don’t know,’ when asked where oil prices may go this year.

Earlier in my career, I found it hard to admit that I didn’t know this kind of thing, but I’ve come to realize that no one else does either and a dose of humility can be valuable – especially compared to hubris, which can be very expensive.

Now, for the predictions on predictions – the second derivative of the forecasting game.

Let’s say you were forecasting earnings for airline stocks. Oil is a major variable and while it’s true that airlines hedge some of their fuel costs, getting one of the major input costs wrong by a 40 percent margin means that your estimates are really off base.

As you might expect, analysts are scrambling to update their earnings forecasts, but, guess what, the prices for airline stocks already reflect the new information about oil prices. Through yesterday, S&P index for airlines is up 92.1 percent for the year. Who got that right?

What about forecasts for Gross Domestic Product (GDP) in China and Russia? China is the world’s largest net oil importer and Merrill Lynch estimates that for every 10 percent drop in oil, GDP growth in China goes up 0.15 percent. They are apparently making use of cheap prices to build strategic stockpiles.

In Russia, which was already on shaky ground thanks to their incursions in the Ukraine, there’s a joke going around asking what Vladimir Putin, oil prices and the Russian ruble all have in common – answer they’re all turning 63 this year.

The key to understanding the punchline is that as the price of the ruble increases, the value decreases. It started the year at 33 rubles per dollar, and at 63 rubles per dollar, it takes almost twice as many rubles as it did a year ago to buy a dollar. In other words, the currency is getting crushed.

The list goes on and on, from Iran where they need $130 per barrel to balance their budget, to railroads in the US that now expect fewer shipments, to burgeoning fracking industry or the Keystone XL Pipeline that was to transport oil from Canada’s oil sands. In all of these examples, the economics are completely changed in just six months and nobody saw it coming.

One last entry on the list of unexpected winners and losers: you and me. It’s just $2.22 per gallon to fill up here in Chesterfield, Mo.