One of the questions that we get from time to time is why one spouses account is outperforming the other. It’s kind of a funny question because it reveals some sort of mild competition between a husband and wife, who are presumably on the same team.

When there is a discrepancy, it almost always has to do with what type of investment we put in certain accounts.

For example, imagine a lovely couple named Sid and Nancy. Sid is retired and his investible net worth of $500,000 is an IRA that was transferred from a 401k plan. Nancy’s employer didn’t have a 401k plan, so all of her $500,000 savings is in a revocable trust.

Let’s assume that we recommended a 50/50 stock/bond portfolio and to keep it simple, let’s say we used an S&P 500 index fund for the stocks and a Barclays Aggregate bond index fund for the bond allocation.

We don’t know what other advisors are doing, but we think it would be pretty common for the advisor to put the 50/50 mix that we advised in each account. One year later, both accounts would have enjoyed the same performance.

Acropolis does it a little differently. First, we assume that Sid and Nancy are a team.

Second, we want to maximize the after-tax returns for the couple, which means using what’s called an ‘asset location’ strategy that means investing the entire stock allocation in the trust (or taxable account, as we call it), and the entire bond allocation in the IRA (or tax-deferred account).

Let’s look at what would have happened over the past five years if we had invested each account identically and if we had pursued the asset location strategy.

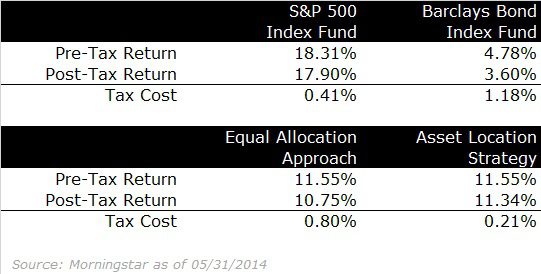

I used two actual index funds and got the pre- and post-tax return data from Morningstar. It assumes the highest Federal tax rate and no State taxes, so it isn’t perfect, but it gets the idea across.

In the top section, notice that bonds are far less tax-efficient than stocks – almost 25 percent of the return is lost to taxes. That makes sense because most of the return from bonds comes from interest income, which is taxed as ordinary income, like wages and salary.

Stocks earn most of their return from appreciation and an index fund is tax-efficient because there isn’t much turnover. So, there are some capital gains taxes and some taxes from dividends, which are preferably taxed compared to interest income (the rate varies now depending on your income, but it’s still better).

In the second table, we can see that the pre-tax return of a 50/50 stock/bond portfolio over this period (and what a period it was!) was 11.55 percent. If we has invested the money identically between the two accounts, we can see that we would have lost 0.80 percent to taxes and our after-tax return would have been 10.75 percent.

Now, using the asset location strategy that we use, the pre-tax return is the same at 11.55 percent, but the after-tax return is much higher and the tax cost is much lower. That’s because we would have earned 17.9 percent on the stocks in the taxable account and earned 4.78 percent on the bond portfolio in the IRA.

Obviously, you want to maximize the after-tax returns and using the asset location strategy yielded an additional 0.59 percent per year in this case. Obviously, the pre-tax returns won’t always be this good, but the tax costs should be roughly constant, which means that this strategy is even more critical in a lower return environment.

The only downside is that the two accounts don’t grow at the same pace – the taxable account holding stocks should grow more over time and is a lot more volatile. The tax-deferred account that holds all bonds grows much more slowly and at a steady pace. It can lose money, for sure, but not like the account holding stocks.

If you don’t have a global view of your accounts, then it can be disconcerting to see one account change a lot more than the other. The key, though, is to remember that all of your accounts in most circumstances represent all of your assets and what you want is to maximize the after tax return for the whole pie.