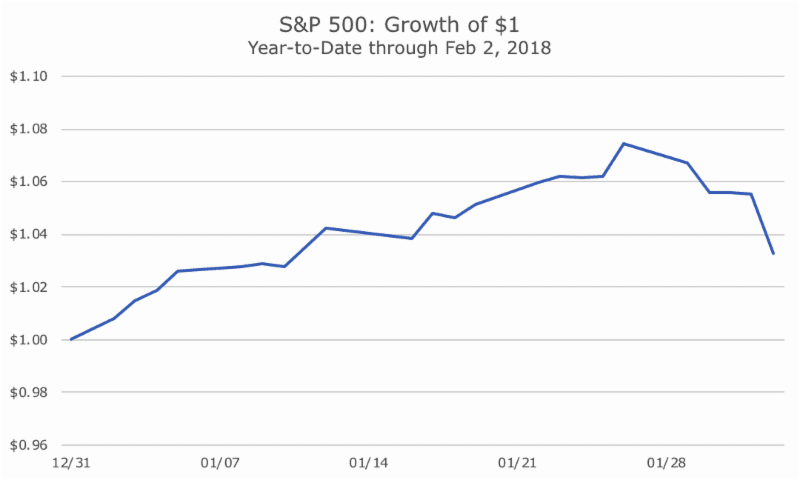

What the heck happened? Stocks were rolling along, picking up steam even, when all of a sudden, out of the blue, ‘POW!’, the index hit a wall.

In reality though, while the move lower was a surprise, it wasn’t really all that surprising. It’s true that I couldn’t have told you the week before that stocks would have fallen sharply last week, but a move like this really isn’t out of the ordinary – it just feels that way because it’s been so long since we’ve had price action like this.

In order to understand what happened to stocks last week, we actually have to turn to the bond market and take ourselves back to the election. When President Trump was elected, stocks obviously roared on expectations that his tax cuts, infrastructure and deregulation policies would spur economic growth.

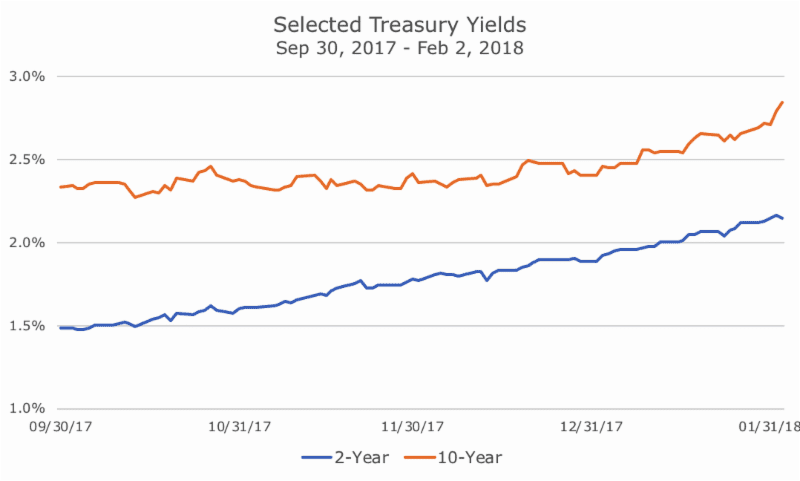

The bond market reacted differently: bond prices fell because along with that economic growth, investors thought that inflation could come back too. Keep in mind that when bond prices fall, yields rise (and vice versa).

After the election, the bond market really settled back down and bond prices drifted higher (which also meant that yields drifted lower) until August, when Trump and the Republican Congress turned their eye to tax reform. At the same time, the Federal Reserve was signaling even more interest rate hikes, which you can see in the higher two-year yield.

While the yield on the 10-year rose modestly at the end of last year, it really started to keep pace with the two-year in 2018. Bond investors were starting to get spooked that growth was going to come in too high and lead to higher inflation, which is bad for bonds.

Let’s see how those higher yields translated into prices. In the third quarter of last year, the Barclays Aggregate bond index gained 0.39 percent, which isn’t great, but isn’t terrible either. This year, in contrast, the bond index has dropped -1.82 percent.

That’s not a huge move for stocks, but it is a huge move for bonds. The yield-to-maturity on the Barclays Agg is right around three percent, so losing -1.82 percent represents about half of the expected return in a given year. I wouldn’t go so far as to call it a bear market for bonds, but January was definitely a tough month.

Throughout January, stock investors pretty much ignored what was happening in the bond market – the excitement was so palpable that it was easy to ignore the bond folks, who tend to be conservative.

But, at some point last week, stock investors took notice and started to get worried because if the economy gets too hot and inflation does rear its ugly head, then the Federal Reserve will have to raise interest rates more than everyone expects.

While the Fed opted to hold steady following Chair Janet Yellen’s last meeting on Wednesday, they signaled higher expectations for inflation in the coming year which could up the number of times that they hike. No one is quite sure what the new Chair, Jay Powell, has in mind, which adds to the overall uncertainty.

What really did the trick on Friday was the better-than-expected jobs report which showed 200,000 new jobs were added to the economy. While the unemployment rate was unchanged at 4.1 percent, the average hourly earnings was much higher than expected at 2.9 percent – the fastest pace since 2009.

Just a few weeks ago, I wrote that the bond market was getting worried about higher wages leading to higher inflation (click here) and this new data added to the worry.

So, the selloff wasn’t completely out of the blue. It wasn’t exactly predictable, but there is some logic behind it. Of course the big question is what happens from here. Like the selloff, it’s unpredictable. Whether it goes higher or lower won’t seem unpredictable in the coming months, but it is because we don’t know what’s going to happen.

I wouldn’t be surprised if this was a momentary blip in a strong rally for stocks – nor would I be surprised if this turned out to be a turning point where investors started to focus their attention on the risks that we face.

The trouble is that each story is compelling enough that we can’t say which one is right. In the future, we’ll know what happened and one of those two stories will look spot on and the other will be… well… forgotten.

The main thing to remember is that this is all completely normal. The last 16 months of low-volatility gains is the exception, not the rule. For all I know, we’ll get back into that pattern this week, but I think it’s safer and smarter to assume that we’ll get back to the more normal pattern of higher volatility.

In either case, stay tuned…