As recently as Christmas Eve, the market believed that there was a 92.4 percent chance that the Federal Reserve would raise interest rates in 2015. The probability is based on prices for Federal Funds futures price contracts at the Chicago Board of Trade (CBOT).

In the first few weeks of this year, I started hearing market chatter that the Fed may have to push off raising interest rates until 2015 given falling inflation expectations globally. Chicago Federal Reserve President Charles Evans told CNBC last Friday that he would like to be patient and, at this point, wouldn’t raise rates until 2016.

The idea appears to be catching on – the implied probability for raising rates in 2015 has now fallen to 73.5 percent. So, the odds are that rates still go up this year, but the idea that they might have to wait seems to be catching on.

All of the talk about the precise timing of ‘lift-off’ makes me wonder what the level of interest rates is that we could actually sustain. I mean, if we’re arguing this much about the difference between zero and 0.25 percent, is it reasonable to think that rates will get back to normal anytime soon?

Over the long run, Federal Reserve officials would like to see the Federal Funds rate between 3.5 and 4.0 percent. Should that be our definition of normal?

Economists do have a tool for estimating what the current level of interest rates ought to be given economic conditions.

The Taylor Rule, named after Stanford economist John Taylor, essentially says that short-term interest rates should be a function of three factors:

1. Actual inflation versus targeted inflation.

2. How far economic activity is above or below ‘full employment.’

3. The level of short-term rates that is consistent with full employment.

Economists argue about whether the Fed should or shouldn’t target inflation and there isn’t much agreement about the definition of full employment.

That said, if we make some assumptions, like that full employment is five percent and that inflation should be two percent, we can see what the Taylor Rule recommends for short-term interest rates.

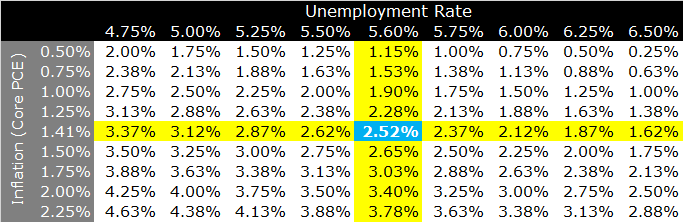

The table below shows a matrix for short-term interest rates with different levels of unemployment and inflation. The column and row highlighted in yellow show the current data, and where those two intersect, in blue, is the Taylor Rule estimate for short-term interest rates.

As I mentioned above, there are some assumptions built into the model and there are other versions of the Taylor Rule. My handy Bloomberg terminal (the source for my data) offers no less than six variations of the model.

Not surprisingly, with different assumptions come different outcomes. The Rudebusch Model (and no, I don’t know how the models differ) suggests that Fed Funds should be at 3.37 percent while the Evans Rule implies that rates should be -0.73 percent (and yes, that’s the same Evans that doesn’t want to raise rates until 2016).

In my mind, even though we don’t get an exact level on where rates should be given today’s economic climate, we can see that the levels aren’t four percent like in the good old days. Second, if inflation keeps falling and unemployment levels off, our expectations for short-term interest rates should decline as well.

In any case, it’s interesting to think about where rates ‘should be’ versus the current levels. Personally, I would love for the stimulus to end so that we could all earn a positive real return on cash. Wouldn’t that be nice for a change?