There is no doubt that the current bull market is remarkable. Yes, it’s true that this bull market was born in a panic and the first three or four years the market was simply getting back to even from the pre-crisis peak.

Since we broke even back in August of 2012, the S&P 500 is up almost 60 percent, which is just a little more than 18 percent per annum. Even if your first and only investment was at the peak before the crisis, the annualized return since then (through the end of May) is still 6.4 percent.

That’s below the long-term average for sure, but it’s not terrible given that this 7.5 year period includes the worst stock market crash outside of the Great Depression.

As happy as we all are about the terrific rebound, the strength and length of the bull market is a little concerning. As I’ve written before, the US stock market appears to be somewhat overvalued (I’ve also written that non-US stock markets appear to be undervalued) and the momentum appears to be slowing down, but I don’t think that we are in another bubble at this point.

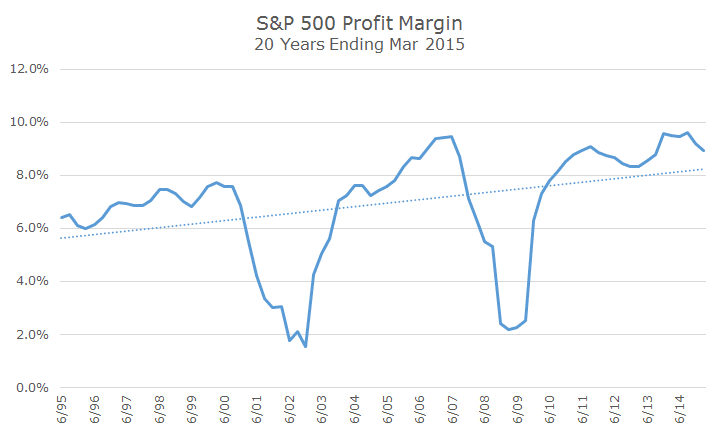

One of the facts that consoles me is that profit margins for US companies are extremely high right now, almost nine percent in the first quarter for S&P 500 companies. Over the last 20 years, the profit margin for these 500 companies has been closer to seven percent.

You can see from the chart that looking at the average may be a little misleading because there are definitely distinct periods of good times and bad times. If you exclude the recessions, the average increases to about eight percent, which means that profit margins are still awfully high.

The Financial Times ran a piece the other day openly wondering why profit margins are so high and offered a few explanations. One pessimistic theory is that CEOs are paid for short-term performance and are sacrificing long-term investment in their businesses to increase quarterly profits that raises their pay.

At the other end of the scale, the pie-in-the-sky idea is that companies are simply more profitable today than they were in the past because of technology. Unlike old industrial companies that have to invest in factories, logistics and heavy equipment (not to mention the legions of people that you need to manage these things), New Economy companies can make more money just by tweaking an algorithm.

At this point, you probably know me well enough to know that I think the answer is somewhere in the middle. While I think it’s true that CEOs do focus more on the short-term than they did in the past, it’s probably because their shareholders demand it. It also seems likely that as our economy shifts from manufacturing to service/technology those profit margins should be higher.

I also think that it makes sense to think that profit margins won’t likely stay this high forever and we’ve got some reversion to the mean in our future that will put pressure on stocks. That could come in the form of a sharp fall like the last two recessions or in a gradual erosion of profit margins (or, again, something in between).

Although I am not a bear, I think it’s fair to say that whatever happens, I don’t believe as Irving Fisher did in 1929 that we’ve achieved a ‘permanently high plateau’ in profit margins or stock prices.