Interest rates are higher and once again it has a lot of investors paying attention to the interest rate risk in their portfolio. Since the Ten-year yield dropped to 2% at the depth of the financial crisis we have had multiple periods of volatility in the bond market when rates rose only to fall back down or in some cases go even lower. Each time the reason was a little bit different but the culprit was usually the same. The most commonly wrote about topic in this newsletter since its beginning has been the Federal Reserve – and for good reason. Their rate cuts (plural) and hike (singular for now), their bond buying campaigns, the taper tantrum, the changing of the guard from Bernanke to Yellen, etc. have garnered the most attention in the market up until now, but things have changed a little bit recently.

The graph above shows future inflation expectations over the last 5 years. As you can tell, the recent move higher is small compared to the trend over the last 5 years, but what’s notable isn’t the magnitude of the rise but the reasons for it.

It’s true that we are on the eve of another Fed rate hike, but changes the Fed Funds Target Rate have very limited influence on the intermediate and longer parts of the yield curve. The Fed’s activity in the bond market, (i.e. QE), had the stated goal of influencing longer-term interest rates, but that policy has remained largely unchanged. Economic activity and price inflation are the more traditional factors that influence interest rates and both are getting more attention as of late.

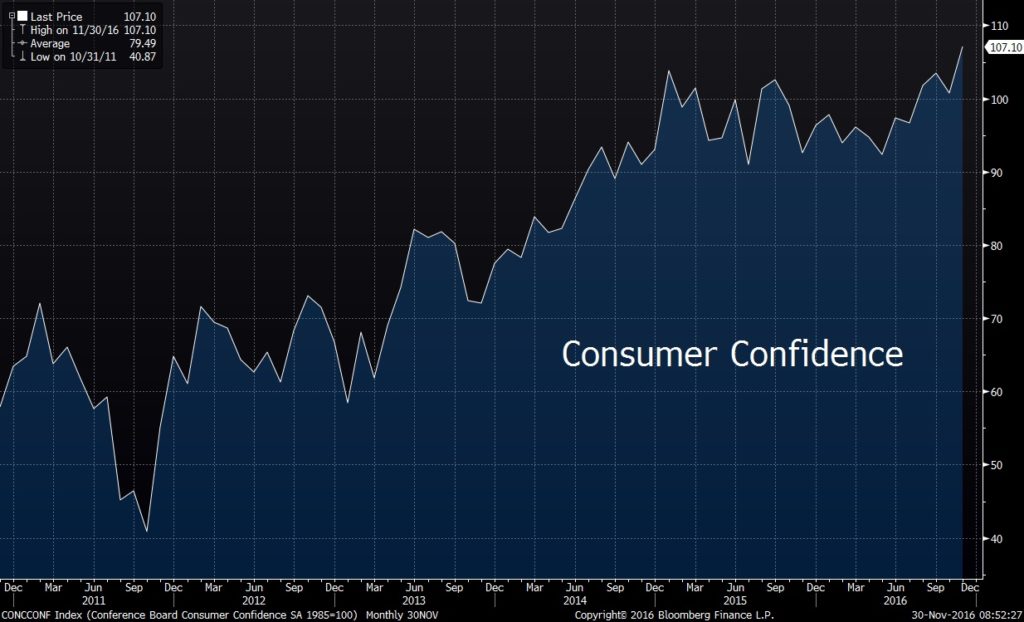

Consumer Confidence is at its highest level since before the financial crisis and recent GDP growth has outperformed expectations on the back of strong growth in consumer spending. The steady drop in inflation expectations since 2014 coincided with the drop in commodity prices, and while oil is still trading at half it’s 2014 value, stronger consumer demand has driven inflation expectations higher.

The other main influence on inflation expectations recently has been the election and the policy changes that are expected to come from the new administration and Congress. The policy is still taking shape, so specifics are spotty, but the two major themes getting the most focus as Trump builds his cabinet are tax cuts and infrastructure spending. Both of which are considered stimulative fiscal policy.

Economics is based in theory, and the reality often doesn’t gel with what is supposed to happen according to the pages of a textbook. That said, tax cuts leave more money in the hands of consumers and as long as they spend at least some of that extra money it should be stimulative to the economy. Arguments against that theory are plentiful but at least for now the market is believing that it will have an influence on inflation. Just today it was announced that Donald Trump plans to nominate Steven Mnuchin as Treasury Secretary and he used his first public comments since the announcement to stress tax reform as his priority.

The new administration’s plans for fiscal stimulus through infrastructure spending is even less clear. Without any true details its even more speculative than tax policy, but the theory is the same. Government spending trickles through the economy and ends up in the hands of consumers who spend it. Just like tax cuts, there are plenty who think the effect is overblown, (or even negative), but for now its pushing inflation expectations and interest rates higher.

While things are a bit different this time, (I finally wrote an article and barely talked about the Federal Reserve at all), it’s not entirely a new NEW normal…or are we on the new NEW NEW normal? I don’t know.

The constant in all of this is that the market continues to adjust prices in an efficient way that makes profiting off of timing moves in interest rates extremely difficult. While the increase in interest rates has gotten some attention from investors, the moves so far has been minor because the information has been thin. The true policy is unknown and the true effect on the market is even more so. It is our recommendation that overall risk tolerance should still be the driving force behind a particular investment strategy. While activity like this does move markets, its unpredictability makes for shaky strategy moves.