While it’s always unclear what will come out of Washington, it appears that the inherited IRA (also known as a ‘stretch’ IRA) may be on the chopping block.

To incentivize retirement saving, the government allows people to make pretax contributions to IRAs and allows the funds to grow without annual tax bills.

Ultimately, though, IRAs are tax-deferred, as opposed to tax-free and the government taxes the money when it comes out. If you haven’t started taking the money by age 70.5, they have required minimum distributions based on your life expectancy.

In the old days, when an IRA owner died, the beneficiaries had a big tax bill to pay when they withdrew the money from the IRA to distribute it to the heirs. Thankfully, those rules were relaxed a number of years ago.

A spouse can rollover the funds to their own IRA or take the RMDs when your late spouse would have been 70.5. There are stricter rules for non-spouse heirs, but there are basically three options.

First, heirs can take the entire balance out, which can result in a large tax bill. Second, heirs can take the money out over the course of five years. For heirs that can wait, however, the best option is to take the RMDs based on your own life expectancy – the stretch IRA.

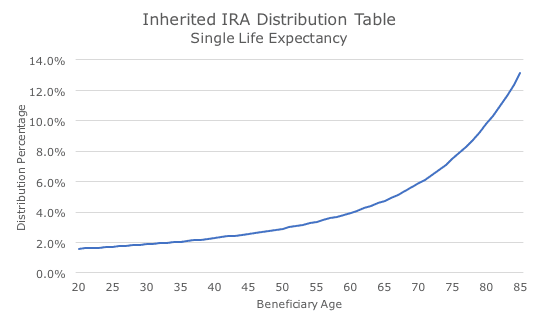

The main reason to stretch is that beneficiaries may have very small RMDs, as outlined in this chart:

The relatively small distribution rates allow the money to continue to grow on a tax deferred basis, thereby stretching the power of the tax-deferral.

The most recent bill in front of the Senate Finance Committee still allowed spouses to rollover the funds into their own IRA, but the non-spousal options would provide just two choices: the lump sum or the five year option.

If the stretch IRA is eliminated, it may change the conversation about Roth conversions (a subject for another day). As always, Congress is the wild card and we’ll just have to wait and see what happens.