You know the Berkshire Hathaway annual meeting is coming up when every financial media outlet has a story on the company or its leader, businessman and investor extraordinaire, Warren Buffett.

My favorite from the weekend was an article in The Financial Times that draws extensively from an interview with Buffett. You can find the article here, but it may be behind a paywall.

One of the points made in the article is just how much Berkshire has underperformed the S&P 500 since the 2008 global financial crisis – effectively for the last 10-years.

In the 10-years that ended on March 31st, Berkshire Hathaway is up 12.5 percent, which is pretty good until you compare it to the S&P 500, which was up 15.0 percent over the same time period.

The 2.5 percent annual underperformance means that the S&P 500 did 30 percent better than Berkshire cumulatively.

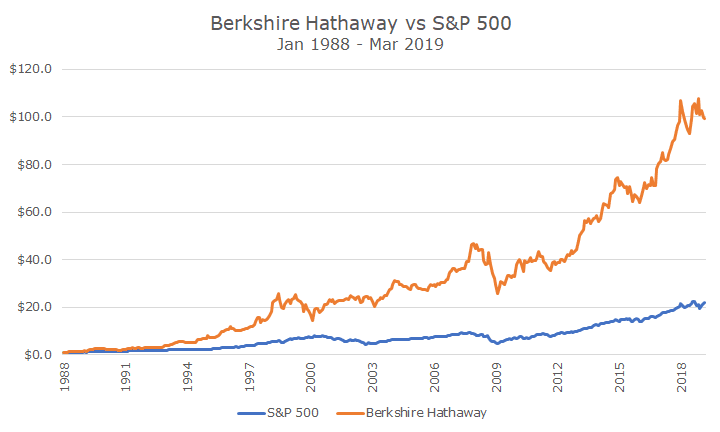

Over the long run, Berkshire has handily outperformed the S&P 500. I pulled some data, but it only goes back to 1988. It wasn’t as quick and easy as I had hoped because he created an A and B share class around that time. Still, you can see that even during this much shorter time horizon, he’s still trounced the large cap index.

One dollar invested in the S&P 500 turned in to $20, which is great, except when you consider that it could have turned into $100 if in Berkshire Hathaway.

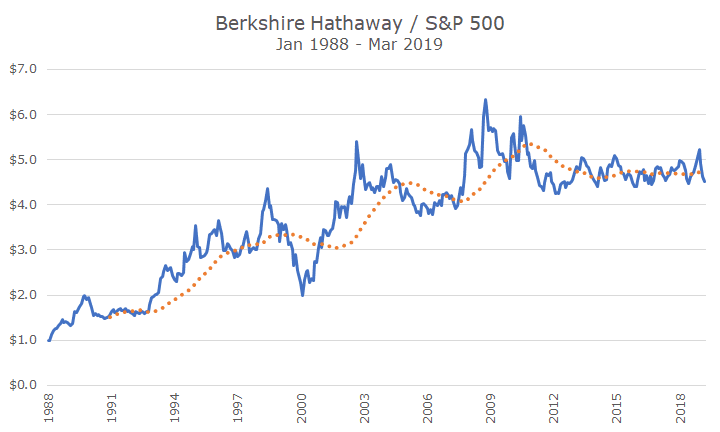

I want to show you the data in a different way though, to illustrate what the last 10 years has looked like; it’s hard to see in the chart above. The chart below simply divides the Berkshire over the S&P 500, and you can see that most of the outperformance took place in the early years.

Berkshire’s kept pace with the S&P 500 since 2012, but has lost ground since the crisis. The following chart shows the same thing, but only looks at the drawdown of Berkshire stock versus the S&P 500.

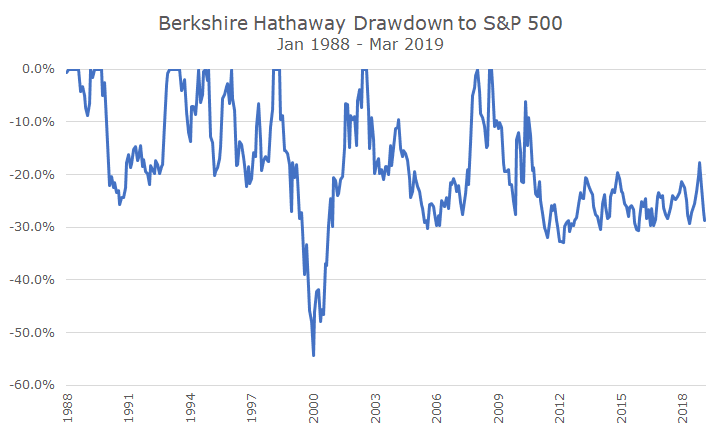

Here you can see that Berkshire has lost ground to the S&P 500 many times since the start of this data set, despite the mega-outperformance since over the same time period.

The period where the underperformance was deepest was during the tech bubble, where Berkshire lagged the S&P 500 by 50 percent. Berkshire still made money during this time, but it didn’t succumb to the broad bubble.

I don’t know how many articles that I read wondering whether he’d lost his touch, but you can see that he gained back all of the ground that he’d lost in three years when the bubble burst.

This stretch of underperformance is a little different because it’s going it’s a lot longer than any of the other ones in this article. The FT says that this is the longest – I believe them, but I didn’t look at the data.

The FT walks through a lot of the issues that may be holding Berkshire back – the huge cash pile, the difficulty of finding large deals, especially with competition from the private equity industry and the question of leadership when Buffett is gone (he’s 88).

Ultimately, they conclude by saying that at the annual meeting, he’ll ask investors to keep the faith and offer one of his quotes: “If you played golf and hit a hole in one on every hole, nobody would play golf. It’s no fun. You’ve got to hit a few in the rough and then get out of the rough. That’s what makes it interesting.”

Of course, as I read the article, I couldn’t help but think of the challenge that we’ve had with value stocks over the last decade. How many times have I had to write that ‘value’ underperformed ‘growth?’ Too many.

Over the last 10 years, the Russell 1000 Value is up 13.5 percent – a full percentage point better than Berkshire. That’s great news, except that the Russell 1000 Growth index is up 16.5 percent.

And yet, it’s clear from the article that Warren Buffett is not giving up on value investing. He’s not promising much of anything about the future, and he’s certainly not throwing out his playbook and changing up strategies even though it’s been 10 years.

I’m advocating the same thing, but it’s hard to do for such a long time, not knowing when things will turn, or, worse yet, whether they will turn. Naturally, I think value will fare better at some point, but if Warren Buffett can’t say when, I’m not even going to try.