Not a single major Wall Street economist forecast that the Gross Domestic Product (GDP) in Japan contracted in the third quarter, so yesterday’s economic release that showed an annualized loss of -1.6 percent came as a real surprise. The average forecast, according to the Wall Street Journal was for a positive gain of 2.25 percent.

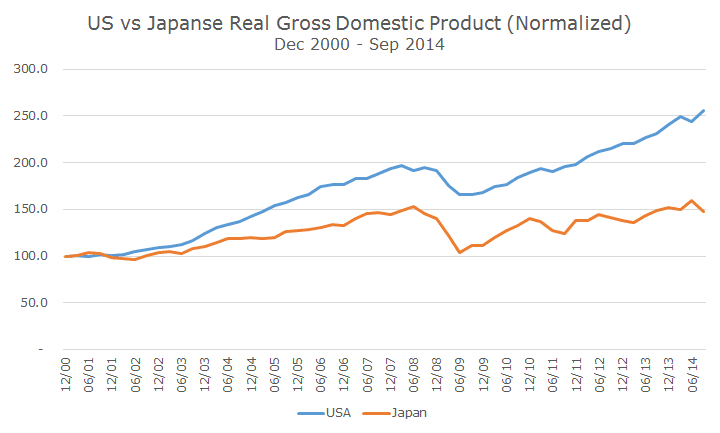

The chart below shows the growth of the US and Japanese economy from an equalized starting point. I wanted to go back further, but it’s actually difficult to find long-term data that is structured so that you can compare the two economies on an apples-to-apples basis.

Still, the thrust of the chart gives the idea: while the US economy has been struggling through a choppy recovery after a terrible recession, Japan’s economy was in far worse shape. Their economy grew more slowly before the recession, was hit harder in 2008, just barely recovered and is now dealing with a sharp downturn.

In addition to the poor third quarter results, the Japanese government revised the second quarter numbers lower to -7.3 percent (annualized).

Although the rules for determining a recession are somewhat more complicated, two consecutive quarters of declines (especially of this magnitude) are a reasonably good indicator.

Part of the reason for the current decline is a recent increase in sales tax that went from five to eight percent in April. Sales taxes were scheduled to increase to 10 percent in October of next year, but government officials are already talking about postponing that hike given the current circumstances.

The plan to raise taxes was intended to curb their massive government debt, which is the highest in the developed world. The debt-to-GDP ratio (which you can think of as debt-to-income) is 227, meaning that for every dollar of goods and services produced in a year, there is $2.27 in outstanding government debt.

By comparison, the debt-to-GDP ratio in the US is 101.53, well less than half that of Japan’s. Even ‘problem’ countries like Greece, Portugal and Ireland have lower levels of debt-to-GDP at 174, 129 and 123 respectively.

The news is disconcerting. Not only because Japan is the world’s third largest economy, but because Europe is teetering on another recession and while the US looks better than the others, these are risks that we face as well.

Japan’s combination of fiscal tightening and massive monetary stimulus (their bond buying program puts ours to shame) hasn’t been enough thus far to pull their economy out of first gear.

As you might expect, Japanese stocks fell by -2.41 percent yesterday, as measured by the MSCI Japan index. For the year, the index is down -3.86 percent.

Interestingly, I just read an interesting research piece by BlackRock, the world’s largest asset manager, arguing that investors should consider overweighting Japanese stocks (we are neutral – not over or under-weight).

Their argument boiled down to these factors:

- Earnings have positive momentum and Japanese companies are buying back stock aggressively that should boost earnings further.

- To stimulate the economy, the Japanese government pension is doubling their allocation to stocks, which should serve as support for stocks.

- The central bank is continuing to support the economy with massive bond buying.

- Japanese stocks are cheap, as measured by the price-to-book ratio.

The first three arguments make sense to me, but I’m not sure the last one is very compelling. While it’s true that Japanese stocks are cheap on this metric, they aren’t on several other metrics.

At this point, we don’t have any plans to change our neutral position. In the back of my mind, though, I can’t help but think of Warren Buffet’s advice to be fearful when others are greedy and greedy when others are fearful.