All markets were driven Friday by the Labor Department report which showed that US employers added jobs in October at the fasted past so far this year while wages rose at the fastest rate since 2009.

Nonfarm payrolls rose by a seasonally adjusted rate of 271,000 last month and revisions for August and September added 12,000 more jobs than previously estimated, bringing the monthly average of 206,000.

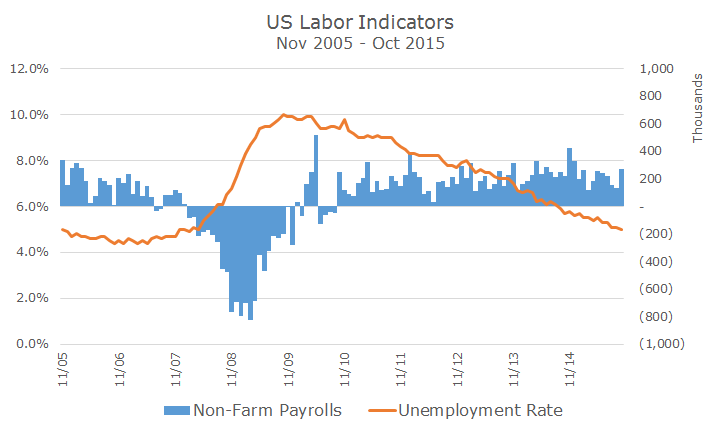

The newly created jobs brought the unemployment rate down two five percent even, the lowest level since the 2008 financial crisis. The chart below shows the non-farm payrolls (in blue) and the unemployment rate (in orange) for the past 10-years.

The Fed now has more ammunition to raise rates in December and Fed Fund futures suggest that the market believes that the odds of a hike in December is now more than 70 percent. Just last week, the odds were around 35 percent, but had jumped to 50 percent based on changes to the statement from the October meeting.

At this point, the unemployment rate is only one tenth of a percent from the Fed official’s median projection for normal long-run unemployment, which bolsters the case for a hike among more dovish members.