The employment situation in the US was worse-than-expected in August, according to new data from the Bureau of Labor Statistics.

The headline unemployment rate fell from 6.2 to 6.1 percent, but as it is often the case, the headline rate doesn’t tell the whole story. For starters, one of the largest contributors to the decline can be explained by a lower unemployment rate among teenagers and other less-educated workers.

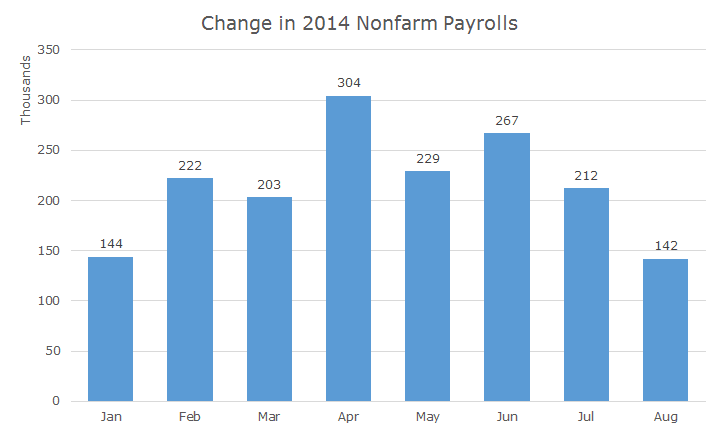

The bigger story is that the economy only produced 142,000 new non-farm jobs, well below the consensus expectations of 220,000 new jobs. Until August, the average number of jobs created each month was 225,000 on average. With August numbers, the average is now 215,000 this year.

Some economists were quick to point out that August is a volatile month for labor statistics due to seasonal factors and that this data will likely be revised higher in the coming months. Furthermore, even with the bad print, the three-month moving average is now 207,000, still above the ‘magic’ 200,000 jobs needed to reduce labor market slack.

Ultimately, this batch of data is a real mixed bag. For example, it’s good news in the sense that we’ve now had 54 months of uninterrupted job growth, breaking the record set in the 1930s. But for every piece of good news, there is another piece of bad news: the labor force participation rate is now the lowest it’s been since the 1970s.

For some time, Wall Street has been betwixt and between about exactly when the Fed will actually start raising interest rates. It’s a funny thing to obsess over in my view because, as long-term investors, all we really need to know is ‘soon,’ or ‘next-year,’ or something like that. It doesn’t matter exactly whether it’s March or August – in the scheme of things, it really doesn’t matter.

The mixed report probably means that Janet Yellen’s Federal Reserve will try and push off raising interest rates for a little bit longer, whatever that is. There’s a debate between the doves and the hawks about when to raise rates and Friday’s data gives a little more ammo to the doves.

I think the feeling is that, all else equal, the stock rally can continue while rates remain low and inflation benign. Of course, all things are never equal and the rally could be disrupted by any number of things like geopolitical tensions, weaker earnings or some kind of unforeseen surprise.

Markets are expensive right now, but that’s not new information, we’ve been writing about it for some time – click here for our take back in February, when stocks were more than 10 percent lower than they are now.

We should be expecting a pull back any time now. We should also be expecting higher interest rates – which don’t have to be a disaster for bonds – click here for a look at how things could play out.

Markets are risky. If they weren’t, the returns would be bad – like cash, in fact. Cash isn’t risky (in the short-run) and there are no returns. Taking risk doesn’t guarantee returns by any stretch, but you can’t get returns without taking risks.

As we’ve said many times before and will many times again: risk and return go hand in hand.